[ad_1]

Guide to what you should know when trading or dealing Bitcoin or cryptocurrencies in Australia.

***.

Australia is one of the countries where digital currencies have seen the biggest boom in recent years. Managing one of the world’s strongest economies, even surpassing the UK financial indices, The nation offers one of the wealthiest spaces for the commercial development of these assets. because of its potential as an investment mechanism to generate high profit margins in the short and medium term.

However, the nation is also rightly recognized for the legal and legal emphasis on regulating cryptocurrencies by the authorities, which at times promotes somewhat controversial measures that generate strong criticism in the international digital currency ecosystem.

Due to the different political, legal, economic and social conditions that characterize the country in contrast to other European and Latin American countries, this new edition of “Everything you should know …” deals with certain considerations on the topics of the country in detail handled Digital currencies in use in Australia.

Legal situation

Australia was one of the first countries to adopt a legal stance on cryptocurrencies for 2013 the director of the Country Reserve Bank (RBA) cataloged Bitcoin as an asset that operates within the legal framework. However, due to certain controversies surrounding the use of the digital currency, the country’s authorities and judicial authorities have repeatedly reviewed a particular position for reassessment in the face of such events.

At the end of 2017 Reserve bank finally decided in terms of Bitcoin and made it clear that, in his view, the digital currency does not require specific regulation. This was reported by the institute’s head of payments, Tony Richards, who pointed out that digital currencies were not an urgent regulatory issue at the time and that they were closely monitoring the development, introduction and use by companies and individuals. Emphasize the care required to avoid the spread of illegal activities (mainly related to tax evasion).

A year later, Richards repeated during an event in Sydney that cryptocurrencies pose no threat to the institution he represents. He added that they do not perceive that it is competing with the Australian dollar as the local currency is listed as one of the most stable and reliable in the world.

In the same year the O.Australian tax office (ATO) opened a public consultation on creating tax treatment for digital currencies to qualify these assets as a taxable property for income related to price fluctuations. This resulted in the granting of a license to companies interested in offering their own cryptocurrencies for sale.

Controversial measures

Despite the fact that government agencies didn’t seem to have any problems with digital currencies, several major banks in the country decided in August 2018 to close accounts for individuals and businesses related to cryptocurrency trading. This measure takes place at a time when the digital currencies have fallen sharply compared to the end of 2017. This has resulted in several financial institutions around the world banning the use of credit cards to purchase crypto assets through reputable exchanges.

In mid-2019, the Australian tax office announced plans to take stricter measures to sanction the use of cryptocurrencies in tax evasion crimes. Among the cases examined was one involving a large international bank.

Friendly cryptonation

Beyond these incidents, many analysts, economists and legal experts classify Australia as a very progressive nation in terms of the approach of Bitcoin and cryptocurrencies.

In the context of the above, the Reserve Bank of Australia Earlier this year, he reported testing with a possible digital Australian dollar that would work through the Ethereum network because of the benefits it offers for this type of initiative.

Recently, the Australian regulator (APRA)assured that the country was in reasonable conditions to present a regulation Libra, the controversial cryptocurrency supported by Facebook In this context, he submitted a draft law to the country’s senate, which contains specifications for the handling of digital wallets and for the use of digital currencies of international scope.

Cryptocurrency mining in Australia

Therefore, there is no ban on individuals or companies interested in mining activities. However, the tax aspect is one of the elements that should be taken into account by those who choose to do this work.

All taxpayers are required to report the profits from mining digital currencies and, in turn, to provide information on the income associated with the transfer of the assets generated by this activity.

In addition, those who perform this activity must duly assume it the costs of electrical energy, bandwidth and corresponding tax obligations if you are a company in the industry.

There are two cases regarding the operation of mining operations in the country: the first concerns companies DC two and D coin, The company announced the opening of the first solar-powered mining operation in 2018. For his part, IoT group in the same year announced an alliance with the company Bitfury for the creation of a mining center in Sydney.

The most popular cryptocurrencies in Australia

Although the country is not as popular as other high-volume trading countries, analysts assert that Australia trades a large number of cryptocurrencies precisely because of the opportunities they offer investors.

As in many countries, the most popular currencies are accurate as an investment mechanism Bitcoin y Ether, for those who enjoy a much more liquid market and have a greater commercial reputation.

However, the exchanges operating in the country allow the purchase of a variety of cryptocurrencies, from which others stand out Bitcoin Cash, Litecoin, Ripple and many others.

Operative exchange

Regarding the stock exchanges that offer their services to residents of the country, there are platforms like Binance, CoinSpot, Independent Reserve, CoinJar, Coinbase, Coinmama, Kraken, amongst other things.

As in other countries, Australian residents can use other platforms P2P how LocalBitcoins and / or LocalCryptos, where they can trade money BTC, ETH and LTC Determine the payment mechanism best suited for them.

Commercial adoption

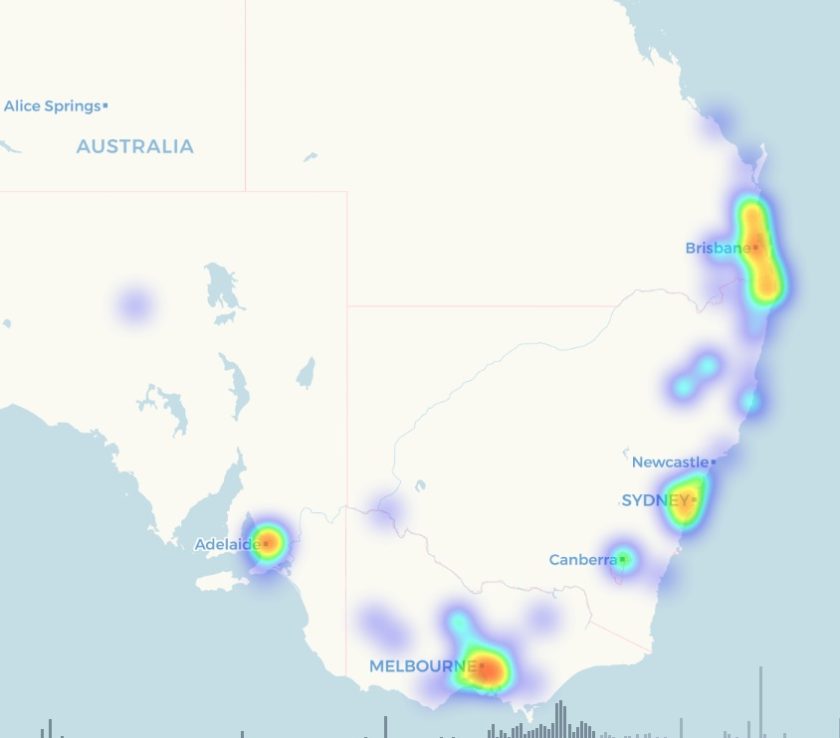

Despite the fact that digital currencies are more beneficial as an investment mechanism for residents, the country has seen a significant increase in the number of companies that accept payments with these assets. In this regard, cities like Sydney, Melbourne and Brisbane stand out More than 250 institutions that receive cryptocurrencies for their products and services.

This is reflected in the portal Coinmap.org, This indicates that the majority of the shops that accept this type of payment are usually tourist venues, ie restaurants, hotels, bars and travel agencies.

There are 20 Bitcoin ATMs nationwide, the city with the most ATMs of this type in Melbourne with 10, followed by Sydney with 7, Adelaide with 2 and Launceston with 1.

adoption Blockchain

Just as the country’s authorities are very open about the introduction and legal treatment of digital currencies, Australia is also listed as a nation that is making significant progress in the introduction. Blockchain.

The biggest evidence of this was in February of this year when the Australian federal government presented a national road map Blockchain, Project that contains a series of plans to increase innovation and adoption of such technologies in many sectors.

The document in question has a total of 52 pages and contains proposals on regulatory issues, innovative capacity and international alliances to create investment opportunities.

On the other hand, a year earlier, the Financial Intelligence Agency The Australian government has announced tests with technology Blockchain to produce reports on border transactions involving bank and financial institutions based in the country. The benefits include transparency and traceability in managing and reporting funds, and automating many parts of the process.

If you want to learn more about other countries, you can see them in the list below, which grows from week to week:

Everything you need to know about Bitcoin and cryptocurrencies in the world

[ad_2]

Add Comment