[ad_1]

The price of Bitcoin

BUY NOW (BTC) shows a clear decoupling from the US stock market. after months of positive correlation.

BUY NOW (BTC) shows a clear decoupling from the US stock market. after months of positive correlation.

If this trend continues, this could reinforce the “uncorrelated assets” argument for BTC, especially since the largest cryptocurrency by market capitalization is preparing for a further halving.

In the midst of the current decoupling, Bitcoin’s positive mood seems to be growing rapidly for both private customers and institutional buyers.

The Bitcoin price separates from the stock exchange

After a Mati Greenspan TweetAs the founder of Quantum Economics, the price of Bitcoin is moving away from the stock exchange.

Bitcoin’s price has risen since late April, while the Dow Jones continues to lag. The same decoupling can be seen when comparing the price development of Bitcoin with that of the S&P 500.

In fact, Bitcoin showed a positive correlation with the US stock market. A Binance report from early April 2020 showed that Bitcoin has a moderately positive correlation with U.S. stocks. during the first trimester.

The sale of the Black Thursday market, one of the worst in Bitcoin history, also reinforced this obvious correlation. While the price of BTC fell to $ 3,800 on March 12, 2020, the financial market also saw massive sales overall, with investors looking to liquidate assets for cash. During the panic the US stock market saw its largest drop in a single day since 1987.

However, this recent coupling contradicts the representation of uncorrelated assets like Bitcoin. Indeed, the lack of correlation between Bitcoin and key investment vehicles is one of the most frequently cited justifications for classifying BTC as a safe haven and for hedging against market uncertainties and quantitative easing. unlimited from central banks.

“Hyperbitcoinization” in focus when the halving approaches

As Bitcoin’s price moves away from the stock market, hyperbitcoinization appears to be gaining strength in both retail and institutional settings. Square’s report for the first quarter shows that Bitcoin volume in the first quarter of 2020 is around $ 306 million, more than 70% of the volume recorded in the fourth quarter of 2019 and more than 400% higher than the figures for the first Quarter of 2019.

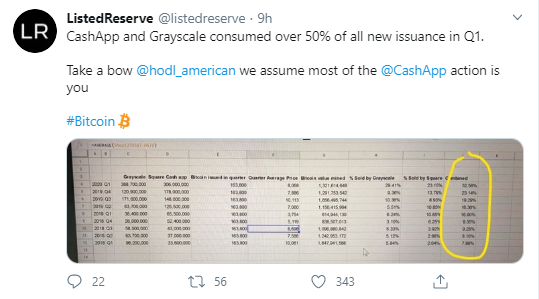

In a tweet on Thursday, Australian Bitcoin fund manager ListedReserve announced that the CashApp and Grayscale Bitcoin Trust entries were available represent half of the BTC exploited in 2020. However, the percentage of these inflows from 170,000 new BTC deliveries for the first quarter of 2020 is not apparent.

The situation is similar in Africa. P2P trading across the continent is reported to exceed $ 10 million, a new weekly high for the region. The current trading volume on platforms such as LocalBitcoins and Paxful exceeds the closing figures in December 2017.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the Cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Read moreRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend to provide sufficient information for a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those contained in the content of this article.

[ad_2]

Add Comment