[ad_1]

The increase in LocalBitcoins seen in Mexico, Venezuela and other countries in the region is growing with interest BTC with view on Halve which will take place in May this year. In some cases, this also affects inflation.

***.

In the midst of an apparently quite good time for the price of Bitcoin, due to the progressive increase in recent weeks due to the proximity of the Halve Online, the international trading platform P2P LocalBitcoins The volume of operations has increased significantly, particularly in the Venezuela and Mexico cases in the past week.

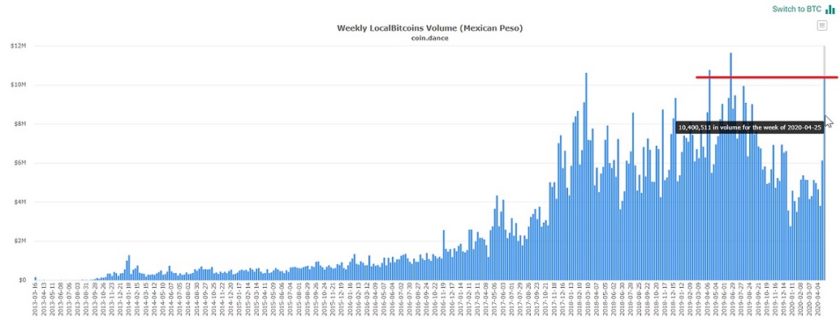

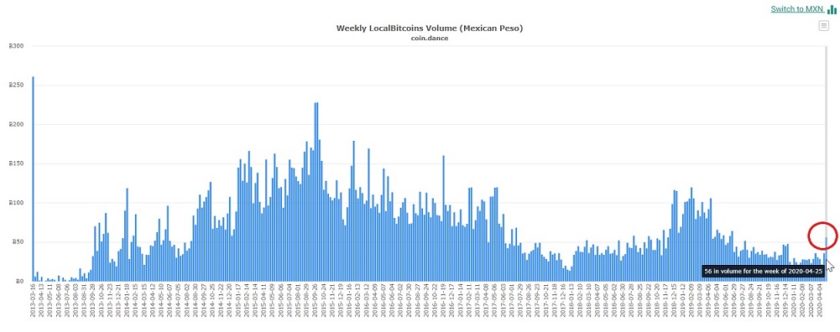

Increase in trading volume in LocalBitcoins Mexico

According to the portal Coin.Dance, Between April 20 and April 26 of this year, Mexico-based users saw a significant increase in Mexican pesos (MXN) business volume.

Data outlined by LocalBitcoins report that users in Mexico have invested more than 10,400,511 Mexican pesos (USD 417,928). This figure represents an increase of more than 40% compared to the previous week to the value of around 6,133,513 MXN (USD 246,466) and is close to the historic maximum at the end of June 2019, calculated at 11,649,023 MXN (USD $ 468,098).

For its part, the sum Bitcoins is traded for this last week 56 BTC, marketed by LocalBitcoins by residents of the country.

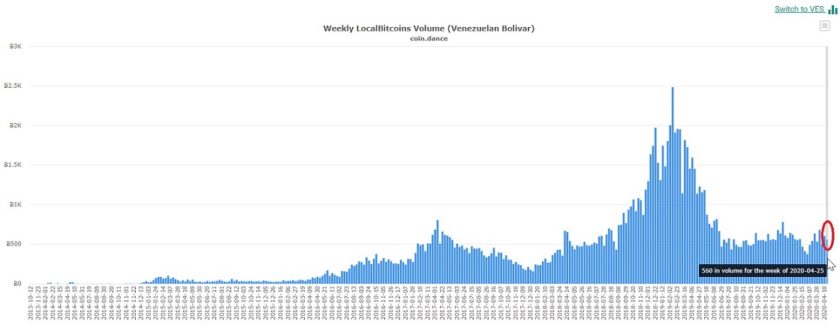

Venezuela: New operating record with Bs. In LocalBitcoins

According to the portal Coin.Dance, for the week between April 20 and 26 this year Venezuelan users saw an increase and a new record in investment in state-owned bolivars (Bs.) LocalBitcoins.

For this reason, users trading within the country have assigned a total of 710,495,314,047 Bs (estimated at USD 3,602,149 by price calculator) BitVen.com). Said capital exceeds the number capitalized last week by more than 20% and is over 538,730,000,000 Bs (USD 2,731,314 at the time of publication).

This historical maximum in Bs. Traded on the platform coincides with a total of 560 BTC, a value that has decreased slightly compared to the previous week when around 604 BTC were traded in exchange for the local currency.

An important aspect to consider in order to understand why less was bought Bitcoins iinvesting a lot more bolivar is last week The price of the US dollar rose significantly on the parallel market in Venezuela, reaching a value of over 192,000 Bs for the first time in the country’s history. Despite the fact that the local economy is currently dollarized, this increase underscores the lack of trust of the South American nation’s residents in the local currency. And that’s why the bolivar loses more value and more is needed to buy anything.

case Argentina

Although the volume of operations with Argentine pesos through LocalBitcoins Between April 20 and 26, it reached 43,192,945 ARS ($ 649,274), which is approximately 55 ARS BTC, This number is below the value of the previous week.

The platform recorded an investment of approximately only for the week from April 13 to 19 ARS $ 46,899,002 ($ 704,787), which leads to the historic record that corresponds to the investment in Localbitcoins calculated in Argentine pesos. Analysts associate this and last week’s trading behavior with concerns about the maturity of three government bonds for $ 500 million, indicating one possible fact default Economy that would have a significant impact on the local economy.

Important dates in Chile and Peru

Finally, the trading volumes of were recorded LocalBitcoins For Chile and Peru, the past few weeks have also shown the growing interest of residents in the digital currency.

In terms of the Peruvian market, we have an investment in soles of around $ 2,374,954 ($ 698,618) 101 this past week BTC. This illustration shows a Bitcoin Much cheaper than in countries like Argentina or Venezuela, where it is traded at least 30% above its equivalent in US dollars.

And finally there is the Chilean market, where the residents sold around 42 Bitcoins for about CPL $ 261,969,381 (USD $ 306,146). However, the highest volume in recent weeks took place earlier this month, when trading volume exceeded 25% between April 20 and 26, at around 330,064,617 Chilean pesos ($ 385,724).

Related articles

Bitcoin continues to rise 15 days after halving, topping USD 7,700 on April 27

The search for bitcoin halves increases on Google by more than 30%, on Twitter and Weibo

Everything you need to know about halving Bitcoin is scheduled for May 12, 2020

With information from Coin.Dance / BitVen / Daily Crypto Markets Bitcoin

Angel Di Matteo’s version / DailyBitcoin

Main image by Gerd Altmann from Pixabay

[ad_2]

Add Comment