[ad_1]

Current data on the market for cryptocurrency derivatives shows that despite the economic crisis that the world is facing, steady growth can still be recorded. The trading volume has increased since 2019 and many companies plan to strengthen their infrastructure and services.

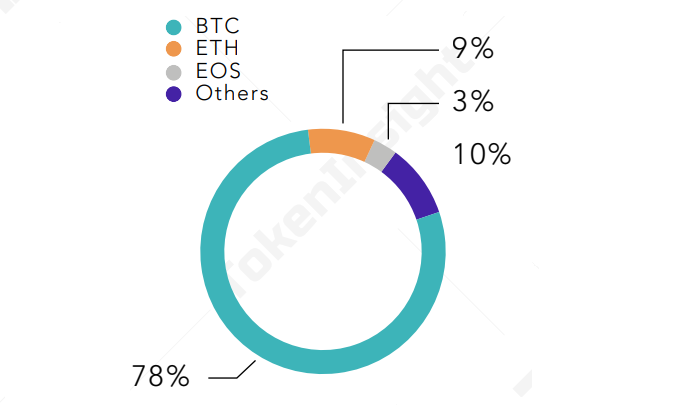

The latest 22-page TokenInsight report shows that the derivatives market is holding up pretty well despite the economic impact of the COVID-19 pandemic. Bitcoin (BTC), Ethereum (ETH) and EOS (EOS) accounted for more than 90 percent of market sales.

The large volumes reported are partly due to the number of exchanges that have brought such investment instruments to the market. Both NASDAQ and JP Morgan representatives have even announced that they will continue to offer crypto futures and options, a move that underscores the belief that drives this niche.

Cryptocurrency trading volume data indicate growth

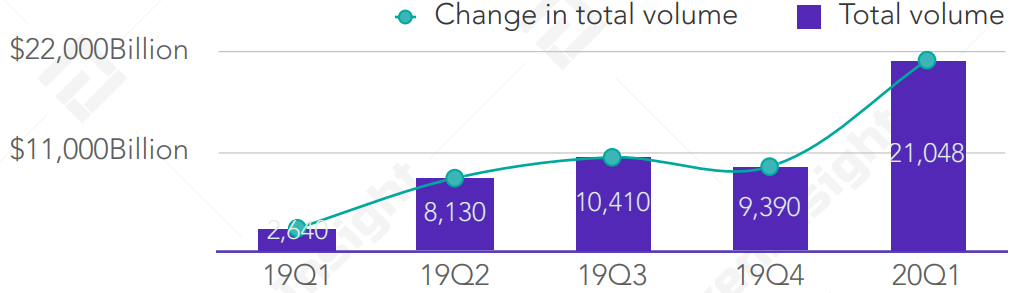

The most notable fact in the report is an astonishing $ 2 trillion in sales in the cryptocurrency derivatives market in the first quarter of 2020, which is 314% higher than the average for the quarter in 2019.

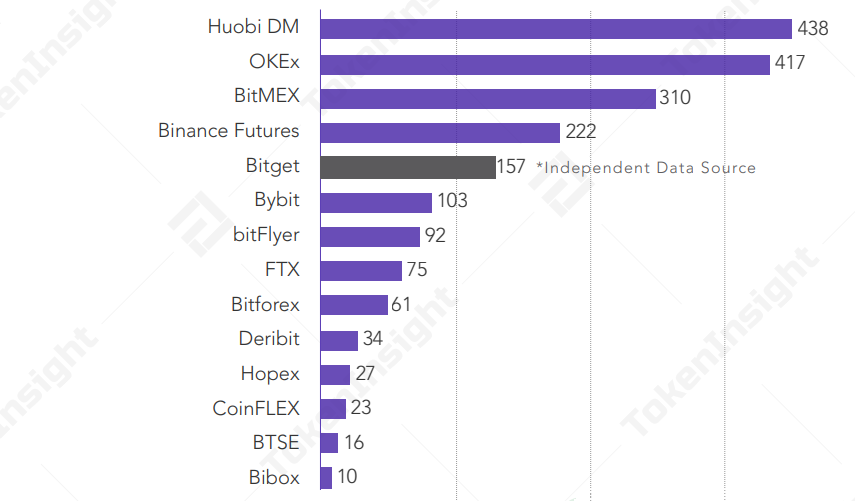

In addition to some rising futures exchanges, TokenInsight analyzed the trading volume of 12 major futures exchanges they offer on the market, including BitMEX, OKEx, Huobi DM, Binance Futures, Deribit and JEX to determine these numbers.

Daily trading volume also suggests increased interest in the cryptocurrency asset class, averaging $ 23.4 trillion and a high of $ 62.5 trillion.

As mentioned earlier, Bitcoin (BTC), Ethereum (ETH) and EOS (EOS) account for 90 percent of the futures contract volume, and Bitcoin itself occupies 78 percent of the market.

The company notes the risks that investors face in an uncertain market that has been mitigated by the COVID 19 pandemic and that the fall of March 13 could be due to lack of liquidity.

He therefore advises against trading non-important futures pairs and sticking to those with sufficient liquidity.

In the most active derivatives platforms, Huobi DM and OKEx hold the top two positions at $ 438 billion and $ 417 billion, respectively. They dethroned BitMEX, which now ranks third with a volume of $ 310 trillion, while Binance Futures, a relatively new addition, ranks fourth with $ 222 trillion.

Other notable conclusions are the forecast that the futures trading volume for 2020 will more than double the spot market and the resilience of the crypto futures market. In spite of the global trend towards cash, the latter has shown growth during this period of great economic uncertainty.

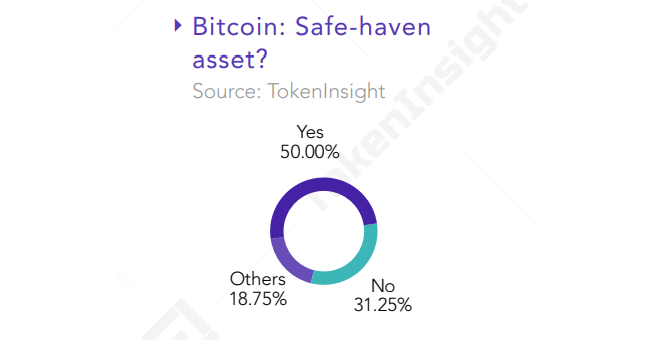

Is bitcoin still considered a safe haven?

The security of Bitcoin as a store of value has been a topic of conversation that has been the subject of heated debate recently. Exactly half of the respondents still believe that BTC remains a safe haven.

The collapse of the market has sparked much discussion about how investment platforms can deal with extreme market conditions. The general consensus seems to be that controlling risk, limiting leverage and strengthening infrastructure should be key priorities in the future.

Infrastructure development, standards and compliance

The report makes clear that general improvements are being made to the fundamentals of this market.

Sam Bankman-Fried, FTX’s Chief Executive Officer (CEO), believes the industry should focus on improving risk control, user interface, fiat currency support, and data quality – an opinion by officials of Deribit, Bitget and OKEx are shared.

The latter’s chief strategy officer, Kun Xu, believes that the market does not yet have to establish a uniform standard that will be an important development as it matures.

Like the absence of stock index futures and index ETFs in traditional markets, the reason is that there are very few underlyings with qualities and the classification and monitoring of underlyings has not established a uniform standard for all markets.

However, Greg Dwyer, head of business development at BitMEX, claims there is an attempt to return to normal:

All asset classes took a risk approach. However, in the area of crypto derivatives, we are gradually seeing a recovery in open positions and an adjustment of spreads to pre-crisis levels, indicating that this confusion is returning to broader cryptocurrency markets.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the Cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Read moreRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend to present sufficient information to make a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those contained in the content of this article.

[ad_2]

Add Comment