[ad_1]

Bitcoin

BUY NOW It has dominated and dominated the market since the creation of cryptocurrencies. The leading cryptocurrency now has much more competition, but can it still be seen as the king of cryptocurrencies, or is its status changing?

BUY NOW It has dominated and dominated the market since the creation of cryptocurrencies. The leading cryptocurrency now has much more competition, but can it still be seen as the king of cryptocurrencies, or is its status changing?

According to a Coinbase report, activity when buying Fiat seems to be developing into cryptocurrency. The User behavior is beginning to shift with direct purchases from Fiat to Crypto. Mark Mason, PR officer, Dash

BUY NOW, stressed the news on Twitter since the data is interesting for every Altcoin project:

BUY NOW, stressed the news on Twitter since the data is interesting for every Altcoin project:

Bitcoin as a bridge from Fiat to the crypto market

Since the beginning of the currency created by Satoshi Nakamoto, only Bitcoin has existed as a cryptocurrency. With the development of the market and the Ethereum, thousands of cryptocurrencies, the so-called altcoins, were created. Even so, Bitcoin has always had a dominance rate of over 50% of the entire crypto market.

Bitcoin’s hegemony seems relentless, but one of the key reasons for using Bitcoin is starting to change. Bitcoin has always been the mandatory bridge to enter the crypto marketIf a person wanted to buy an old coin, they first had to buy BTC.

Coinbase is like BTC for the exchange market, for many users it is the inbound exchange. This is due to the fact that great efforts have been made to offer the simplest possible service and that great marketing efforts have been made before the 2017 boom. This means that a large majority of new users go through this exchange before switching to other platforms.

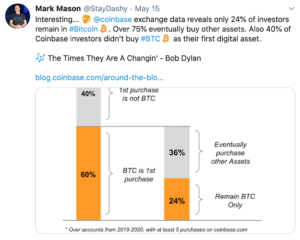

According to the study 75% of Coinbase purchases are made from Fiat to Crypto, from Fiat to Altcoins. This is very important as Bitcoin has always been almost the only way to buy altcoins.

Based on this data, it should be made clear that Coinbase offers the purchase of cryptocurrencies in packages, an easy way to diversify an investment with all of its digital currencies. Therefore, this information should be taken with caution. However, if it is crossed with the data that almost the 40% of Coinbase users don’t even own Bitcoin it gives the narrative greater strength.

The price says something else … Bitcoin is still the king

These reports can confirm the argument that altcoins on number 1 cryptocurrency are gradually gaining ground. It’s normal for altcoins to grow in importance with so many suggestions, but at the moment the price speaks for itself.

Bitcoin has seen a sharp decline since the ICO bubble, but continues to resist at a medium level and with various forecasts of price increases due to halving. In contrast, The vast majority of old coins have lost 90% and they still stay at these levels. Bitcoin basically remains the most successful cryptocurrency in the long run when it comes to price.

So far this year, Bitcoin has been the leading cryptocurrency that far dominates the entire crypto market. Currently, the writing of this article monopolizes 67% of the cryptocurrency market. Even if Halving shook the miners, the dominance ratio continued to increase.

We can conclude that altcoins may get more attention than before, but Bitcoin remains king and there aren’t many signs to the contrary, especially when BitInc’s dominance, according to BeInCrypto, peaks in 2020.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Continue readingRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend and do not intend to provide sufficient information for a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those listed in the content of this article.

[ad_2]

Add Comment