[ad_1]

For some reason the lengths are from Ethereum

BUY NOW At Bitfinex, they are the dominant operations. Almost that 90% of all margin traders trade with ETH for a long time on the stock exchange.

BUY NOW At Bitfinex, they are the dominant operations. Almost that 90% of all margin traders trade with ETH for a long time on the stock exchange.

The overwhelming number of lengths by the ETH make some speculate that we might see a “length squeeze” soon, or maybe these dealers know something the rest of us don’t know. There is confusion as to why Bitfinex margin trading is so predominantly long.

Bitfinex dealers are betting on profits

At the time of writing, almost 90% of margin traders are at Bitfinex, for a total volume of approximately $ 314 million. BitMEX is only 47% long, but the volume is many times smaller than in Bitfinex.

According to lowstrife (@strife), approximately 1.975 million ETH were long and only had a margin at Bitfinex. This is around 1.8% of the circulation offer.

1,975 million ETH (1.8% of the total circulation offer) are now marginal on Bitfinex. Bitfinex only.

+ 250k have just been filled in the last 4 hours. pic.twitter.com/xOOrxNR8gw

– Lowstrife (@lowstrife) April 10, 2020

These lengths have been maintained since then despite the relatively weak price movement Bitcoin

BUY NOW (BTC) continues to bleed. Most BTC margin requests, 61% at the time of writing, are also long.

BUY NOW (BTC) continues to bleed. Most BTC margin requests, 61% at the time of writing, are also long.

Although the S&P 500 has risen 1.5% today, Bitcoin has not followed. The leading cryptocurrency has fallen below the $ 7,000 price and is now down 5.25%. Traders may expect BTC and ETH to follow traditional financial markets, but so far this has not happened.

Confusion about what’s coming

The overwhelming number of margins at Bitfinex has caught the attention of traders. Some speculate that ETH has set up a long-term fund. Trading volume fell in March and price activity has been uneven since then, but could bottom out. Still others see this as a trick to reduce margin trading. The macroeconomic outlook remains a concern.

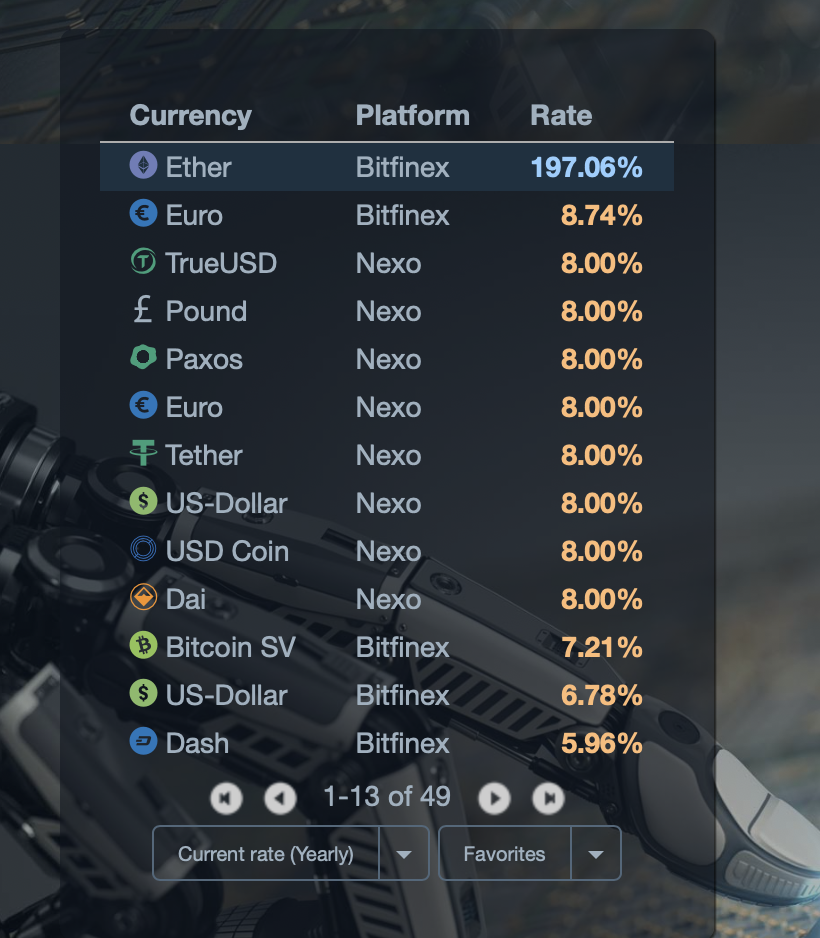

The annualized interest rate for ETH at Coinlend is currently an impressive 197%. The increase could be related to trading long ETH margins on Bitfinex.

Many traders are waiting on the sidelines to see how this develops. There is also speculation that this is a period that will lead to the publication of “Phase 0” of ETH 2.0, which is expected to be launched in July. However, it should be noted that even with the release of “Phase 0”, Ethereum 2.0 will not be fully functional for many years.

Perhaps this is the beginning of Ethereum, which is leading the market for a short time instead of Bitcoin.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the Cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Read moreRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend to present sufficient information to make a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those contained in the content of this article.

[ad_2]

Add Comment