[ad_1]

After the fall of April 21 on the oil market Bitcoin and the major digital currencies are dawning, particularly highlighting the decline ZCash in the past 24 hours.

***.

In the midst of the historic decline seen in major markets oil prices yesterday, particular emphasis was placed on what was seen in the United States West Texas Intermediate (WTI), the price of Bitcoin and major cryptocurrencies dawn on April 21 and show again that while these technologies are suggesting important advances in financial matters, their commercial development will not work regardless of what is seen in the traditional ecosystem.

Bitcoin hovers at $ 6,850 this April 21

We start this analysis by examining the price of Bitcoin (BTC), As the major digital currencies register at 9:30 a.m. (New York time) this April 21, this is equivalent to a price of $ 6,850, a decrease of at least 3% from yesterday’s level.

An interesting fact that can be seen in the graphs has to do with the specific moment of autumn, since after the localization in the morning of April 20, over USD $ 7,000 Bitcoin begins its journey down at 12:10 p.m. Over the next four hours, the price of the digital currency drops to a minimum of USD 6,840 and behaves erratically for the rest of the day without exceeding USD 6,900.

In terms of volume of day-to-day business, the moment the price drop occurred, there was an increase of at least $ 4 billion, so this indicator has stayed at $ 37,117 million in the last 23 hours.

ether and the main Old coins They go under too

The local currency of the Ethereum, ether (ETH), is down 4.11% in the last 24 hours and is trading at around USD 172 per unit at the time of publication.

Similar to the case of Bitcoin, the daily trading volume of the ether It rose significantly between 12:00 p.m. and 4:00 p.m. and was over USD 20,224 million during the hours the decline continued.

On the other hand, with losses between 2 and 5%, we have the cases of Ripple (XRP), Bitcoin Cash (BCH), Bitcoin SV (BSV), Litecoin (LTC), Binance Coin (BNB), EOS, Tezos (XTZ) and Chainlink (LINK)whose prices are around USD $ 0.18 / USD $ 221 / USD $ 182 / USD $ 40 / USD $ 15 / USD $ 2.5 / USD $ 2.14 and USD $ 3.47 respectively.

The largest loss among the most reputable currencies is recorded exactly ZCash (ZEC) with a decrease of more than 9%, which was trading at around USD 41.9 at the time of publication.

If you want to see which currencies had the highest gains and losses, you can see our graph here:

Win cryptocurrencies

| ENJ | Enjin coin | 3.4% | $ 0.11 |

| Nexus | Nexus | 1.11% | $ 0.10 |

| OMG | OmiseGO | 0.6% | $ 0.58 |

| LEO | UNUS SED LEO | 0.34% | $ 1.04 |

| PAX | Standard Paxos | 0.23% | $ 1.01 |

Lose cryptocurrencies

| ZEC | Zcash | -8.96% | $ 42.07 |

| XZC | Zcoin | -8.52% | $ 3.86 |

| MOON | Terra | -8.51% | $ 0.20 |

| MIOTA | IOTA | -7.84% | $ 0.15 |

| KMD | Komodo | -7.53% | $ 0.53 |

DiarioBitcoin.com

Comparison: ecosystem Bitcoin against oil market before April 21

Given the recent drop in prices from Bitcoin Given the historic drop in oil prices in the main markets, it would be useful to assess how these markets behaved over the course of 2020.

Price development of Bitcoin

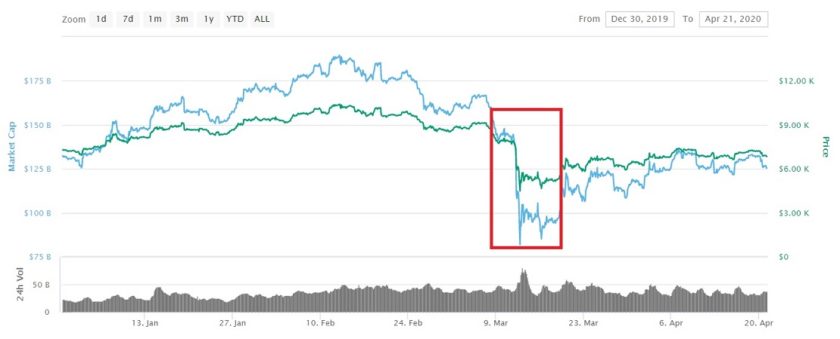

According to data from CoinMarketCap, Bitcoin It will open this year at a cost of approximately USD 7,215 per unit. This value gradually increases over the weeks until the mid-February 2020 peak of over USD 10,330 is reached.

However, the prospects for the digital currency have changed radically since the beginning of March this year, when the crisis caused by the coronavirus pandemic begins to increase. Since 7 of this month Bitcoin Fall begins in three days and is quoted at around USD 7,900. However, the most chaotic moment occurred on March 12, when the cryptocurrency fell below $ 5,000 in less than six hours of trading.

After a period of severe irregularities, the digital currency gradually began to recover over the following days until the $ 7,000 barrier was overcome on April 6 this year. It finally reached over $ 7,200 on day 18, but as the oil market contracted, the price fell again and was $ 6,850 at the time of publication.

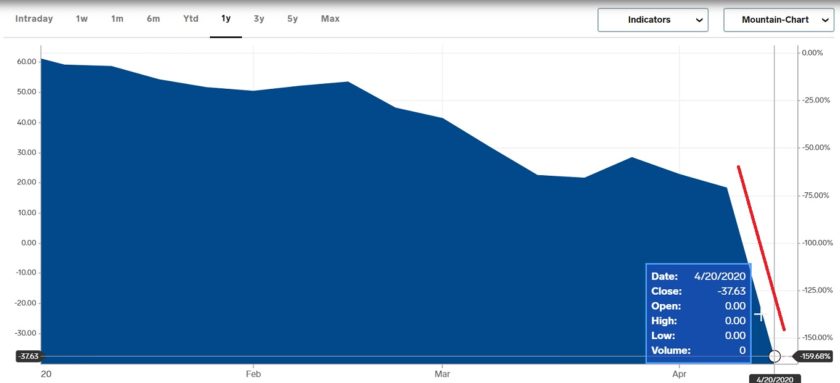

Development of the oil price WTI

Before assessing the price history of this product, it is important to make an important precision because when discussing the West Texas Intermediate (WTI) We are referring to an oil other than that specified on the market Brent. In this case, it is crude that is primarily extracted from the Texas and Oklahoma markets, the quality of which is superior and serves as a direct reference for the American markets, while its counterpart is chemically heavier and mainly reflects the price of the European ecosystem .

Taking this accuracy into account after data is extracted from Businessinsider.com, the oil price WTI It opened in 2020 and reached over $ 60 a barrel (equivalent measure for 159 liters of hydrocarbon). As a result, the price started to drop until a price of $ 53.3 was recorded in mid-February after a slight recovery.

From that moment, the price of WTI oil begins to fall sharply, as its value is reduced by more than 50% a month later and reaches around $ 21.5.

However, the most critical moment for crude oil begins on April 6 this year as it begins to decline after a slight drop above $ 22 and for the first time in its history since April 20 Trend currently around USD -37.63

Time of economic uncertainty

Following the impact on major markets due to the progression of the COVID-19 coronavirus pandemic, this drop in the price of crude oil is causing many countries to experience economic difficulties, particularly countries such as Venezuela, whose economy is based on more than 95% of oil rental income.

However, a large number of analysts argue that the impact of this measure could also affect the economies of the Latin American countries, as the finances of some nations in the region also depend heavily on oil barrel prices. In a strategic move by the US government, it announced the purchase of at least 75 million barrels as a reserve, which could be of great use in a scenario where the price will rise in the coming months.

For his part, however Bitcoin It is not far from the traditional financial markets. Statistics show that his trading behavior during the pandemic was much more stable than that of the stock exchanges. This was evidenced by a report submitted by the service CryptoCompare, This shows that besides gold, the digital currency performed better than indices like the S&P 500 or others related to the stock markets.

Today, the stock markets have also withdrawn as a result of the drop in oil prices. The index this morning Nasdaq reflects a 3.86% decline while the Dow Jones It has dropped by 2.78%.

Related articles

Experts are analyzing Bitcoin’s capacity in the face of an unprecedented drop in oil prices

Bitcoin was $ 7,000 today, but had better trading performance than the stock market last month

Sources: CryptoDaily MarketsBitcoin, CoinMarketCap, Businessinsider

Angel Di Matteo’s report / DailyBitcoin

Image created with Canva

[ad_2]

Add Comment