[ad_1]

Transaction fees Bitcoin

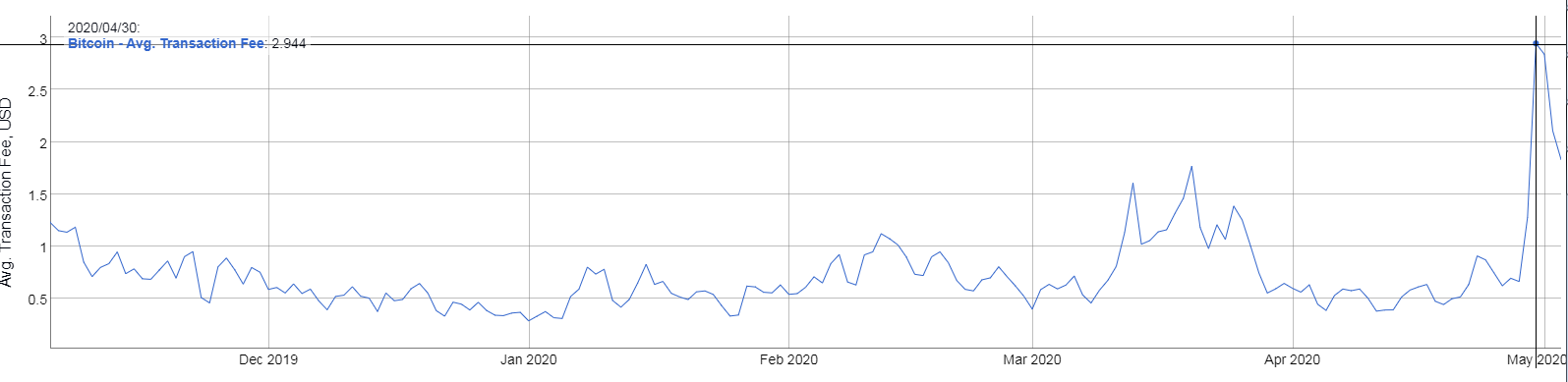

BUY NOW They are currently at their highest point in the past 10 months as the third halving approaches, which is expected to occur on May 12th. General interest among buyers has increased, as have other indicators that show that the network is experiencing an upward trend in almost all facets.

BUY NOW They are currently at their highest point in the past 10 months as the third halving approaches, which is expected to occur on May 12th. General interest among buyers has increased, as have other indicators that show that the network is experiencing an upward trend in almost all facets.

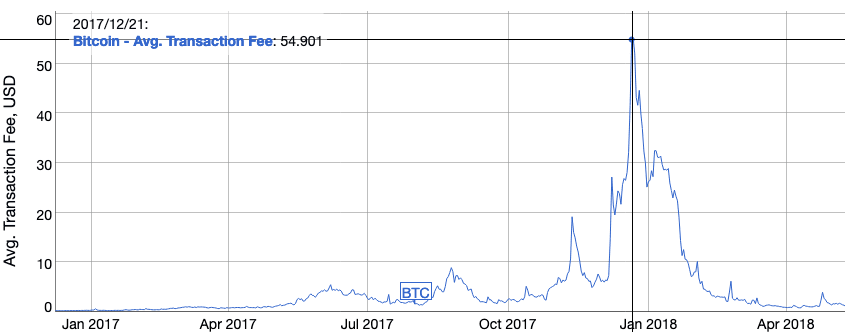

The apparent surge in Bitcoin purchases, which has raised the price by almost $ 1,500 in two days, has caused the network’s transaction fees to skyrocket by an amazing 450% over the same period. A similar trend was observed at the end of 2017 when the entry of large buyers led to unusually high transaction fees.

Transaction fees reached more than $ 2.50, the highest level in about 10 months. In June 2019, commissions were over $ 6. In the upward trend from late 2017 and early 2018, some commissions were still over $ 30 when many new investors entered the market.

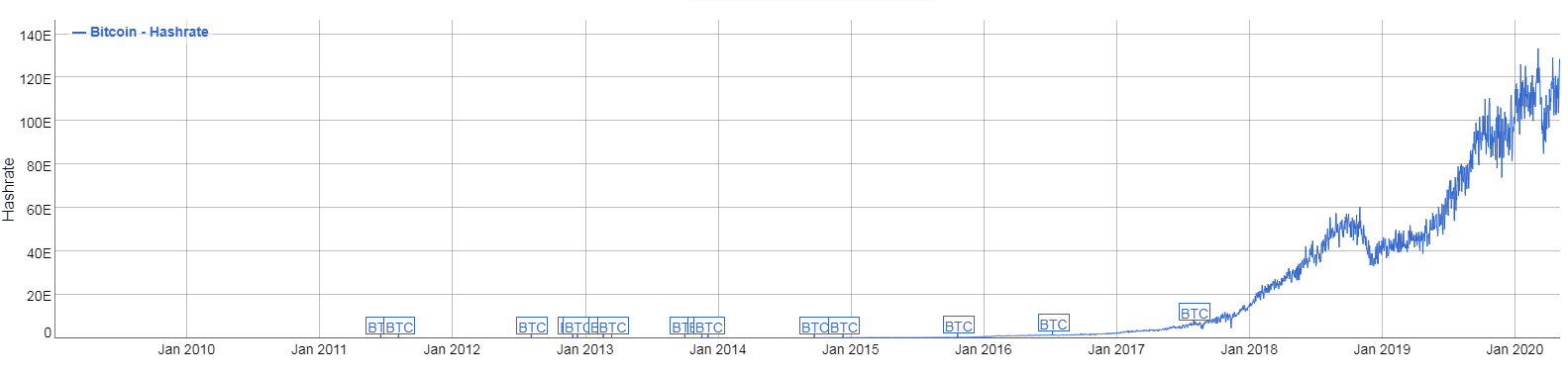

The story seems to repeat itself with several indicators that point to the growth of the network. Some have argued that miners’ efforts to compensate for half of the compensation could affect the network, but network statistics have shown no signs of such a development.

Bitcoin hash, volume, and rates increase before halving

However, the halving has already been revealed, and numerous indicators from the network indicate buyers who are trying to buy, hoping that the block premium reduction event will push up prices in the medium and long term.

The volume of trading in options increased in April, as did the constant exchange. A report released by TokenInsight last week shows that enthusiasm for crypto derivatives remains constant, while a report by Grayscale Investments shows encouraging numbers for institutional investments.

The network’s hash rate of 128 exahashes / second is also close to its all-time high, indicating that miners have no hesitation in contributing to mining. The hash also increased after earlier halving in 2012 and 2016.

Another sign of positive growth are the Google search queries, where the search term “Bitcoin halving” is close to its all-time high, although overall Bitcoin search queries are far from the level at the end of 2017.

Halving already in sight

The enthusiasm for the upcoming halving, which is expected to take place on May 12, has put investors in a state of high expectation.

Halving will reduce miners’ rewards from BTC 12.5 to BTC 6.25. Many believe that the reduction in supply will lead to an increase in price over time, although previous reductions have shown that this recovery usually takes several months.

The halving, combined with general network development and the inflow of space investments, has led to increased confidence in cryptocurrencies as an asset class and in Bitcoin as a store of value.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the Cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Read moreRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend and do not intend to provide sufficient information for a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those contained in the content of this article.

[ad_2]

Add Comment