[ad_1]

Bitcoin

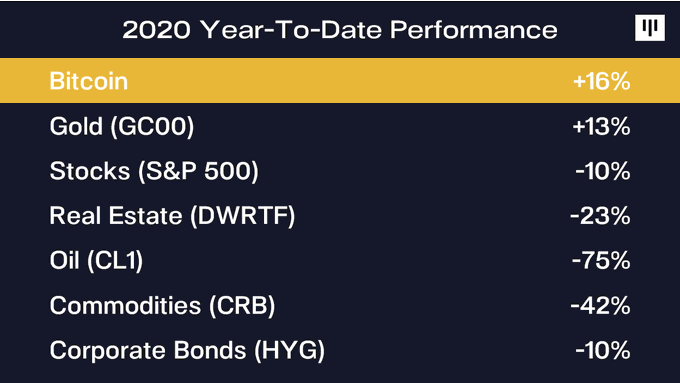

BUY NOW According to figures released by Pantera Capital, it was named the fastest growing asset of the year in 2020. This puts you ahead of assets such as gold, oil and real estate.

BUY NOW According to figures released by Pantera Capital, it was named the fastest growing asset of the year in 2020. This puts you ahead of assets such as gold, oil and real estate.

Bitcoin enthusiasts have often said that BTC is the next great investment tool to be used worldwide, preferring it over traditional investments like gold and stocks. These enthusiasts have reason to celebrate, as reported on April 29, 2020 by Dan Morehead, CEO of Pantera Capital, that the The cryptocurrency has outperformed gold in performance since the beginning of the year. Bitcoin has grown 16% since January 1, 2020, while gold is 13%.

#Bitcoin has outperformed gold so far.

Bitcoin was born in a financial crisis. It grows up there.

Bitcoin and cryptocurrencies in general have always been compared to traditional investments, especially during the current COVID-19 outbreak. This has sparked a debate over whether cryptocurrencies are better investments in times of crisis.

The chart published by Morehead shows that stocks, oil and real estate are showing negative growth, while gold and cryptocurrencies are thriving.

Morehead has long supported Bitcoin

It’s not the first time that Dan Morehead speaks positively about Bitcoin as he seems to be a vocal proponent of the coin. In a recent letter to investors, he said that after the 2020 economic crisis, Bitcoin would grow up and exceed its historical price. This is a feeling that Morehead repeated in his latest tweets about digital currency.

Although he has high hopes for Bitcoin, he has made grim predictions about the global economy as a whole. According to him, the upcoming global recession will be worse than anything the post-war world has experienced.

In July 2019, Morehead had predicted that Bitcoin would reach $ 42,000 by the end of the year and $ 356,000 soon after.

When he appeared on the “Unchained” podcast, he also claimed that the technology behind cryptocurrencies would improve to accommodate more users. However, this optimism did not extend to all tokens, as he believes that most altcoins will ultimately fail.

That puts Bitcoin at $ 42,000 at the end of 2019. I know that sounds crazy, but we’re essentially halfway there.

Will bitcoin grow up in a time of crisis?

The past few months have been interesting for investments and assets overall. The COVID 19 outbreak had a huge impact on the global economy, including cryptocurrencies. Some like Morehead have theorized that Bitcoin will mature during this time and secure its place as an investment of choice in the event of uncertainty.

Its growth this year despite the outbreak could prove this theory. One of the possible reasons for this is that Bitcoin was designed in the context of the 2008 recession and was therefore designed for an economic crisis.

Another possibility is that the accessibility of the currency makes it easier to invest or exit during a crisis compared to an asset such as real estate.

But not everyone feels that way. Both gold and bitcoin suffered price cuts in February and March this year. Gold has risen since then and is now approaching its highest level in seven years. Bitcoin has recovered somewhat, but is nowhere near the peak of the past seven years. This is often cited by gold supporters as the reason for the superior investment.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the Cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Read moreRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend and do not intend to provide sufficient information for a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those listed in the content of this article.

[ad_2]

Add Comment