[ad_1]

***.

The project has been around since its inception Bitcoin It was conceived as a proposal for creating decentralized money, the management of which fell directly into the hands of its users, without the need for intermediaries to facilitate the process.

The big leap that revealed the ease of use of the digital currency, however, took place on May 22, 10 years ago, when Laszlo Hanyecz offered a total of 10,000 to the user community BTC Who could bring two pizzas? From then on, many enthusiasts saw the possibility of employment Bitcoin Buying products or services because there were people interested in accepting them as a payment mechanism.

Hence 10 years after the first Bitcoin Pizza Day and given the multitude of changes in the digital currency ecosystem, we judge whether today Bitcoin It is still effectively listed as a payment mechanism for products and services, or if it has become the opposite of a financial product that can be better used for other purposes.

The Bitcoin with which he paid two pizzas

For the month of May 2010 Bitcoin It was still a digital asset, the reputation of which was not widely known. Therefore, discussions and interesting topics related to the cryptocurrency mainly took place in special forums and dark web communities.

Especially in this case Laszlo Hanyecz posted a message on the forum BitcoinTalk on May 18 this year, in which he stated that he would pay the equivalent of 10,000 BTC to buy some big pizzas that could be bought in a store or made by someone. However, the enthusiast had an effective response four days later when one person accepted the deal and brought him two pizzas out of the franchise. Popes Johns.

The relevance of this day to the community was very remarkable as it was the first gift in which a user could use his money effectively. Bitcoin Purchasing a product in the real world to prove that there is an interest in digital currency and that it can be used as a payment mechanism, although the mediation and lack of practicality of the process left something to be desired.

Another interesting aspect is that this transaction has created a kind of exchange rate between Bitcoin and the legal tender since the 10,000 BTC In this operation, they corresponded to a total of USD 41, a transaction that took effect almost immediately and was confirmed in the next 10 minutes.

How did it develop? the digital currency after Bitcoin Pizza Day?

From that Bitcoin Pizza Dayand after an important series of events, Bitcoin started to gain more and more commercial reputation. We have already spoken about the emergence of a cryptocurrency market that provides estimated value data based on information reported by various exchange platforms.

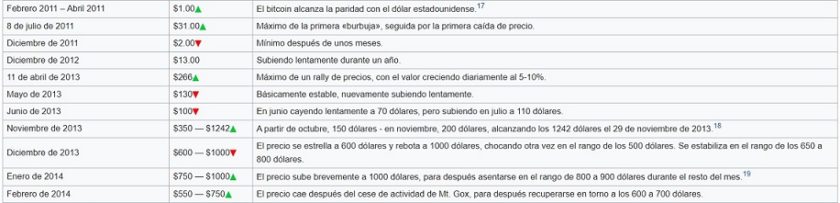

According to data from Investing.comFrom February 2011, the digital currency temporarily reached parity with the US dollar and has exceeded this mark since April of the same year. At this point, users who had knowledge of the digital currency and were investing their dollars to make money BTC They made significant gains based on information from the price indices available at the time.

From that moment on, major milestones and falls came at the price of Bitcoin. However, the most shocking event for the digital currency community took place between November 2013 and February 2014. when the coin crosses the $ 1,000 mark and it is beginning to attract the attention of companies and investors interested in capitalizing on the asset’s value.

Increasingly obvious operational problems

While the digital currency ecosystem has seen significant growth over time, the extent to which the project has been achieved has been very difficult for the existing infrastructure and code. This led to congestion problems and increased commission margins, which hampered the usefulness of the digital currency as a means of payment for products and services.

Since then, many have seen more value in the digital currency than value funds, particularly due to the large commercial development in a very short time and the future prospects due to its deflationary properties. This attracted a large number of prospective buyers Bitcoin and save it in the hopes that its value will multiply, which happened in 2017 when the cryptocurrency again crossed the $ 1,000 mark and began to rise to the highest prices in its history.

Between 2014 and 2017 The community has been the epicenter of burning debates about the relevance of certain changes to solve network operating problems Bitcoin, Agreement on the need to increase the size of the blocks, but differ in the recommended limit and openness to creating other types of solutions.

“Good money for bad money”

While all of this was happening the pronounced commercial development at the price of Bitcoin In 2017 it raised strong expectations for its future, As a result, there were many analyzes and forecasts that assumed high prices for the coming years. This gave the movement much more power HODL (Save this Bitcoins), where a large number of enthusiasts started saving theirs BTC I’m waiting for big returns in the future and even compare the digital currency as the equivalent of gold in the virtual world.

In this way, Bitcoin It ceased to compete with major legal currencies to make room in the stock market world, and in some ways competed with items such as gold, oil, and the stocks of reputable companies listed on the major stock exchanges. , already aside from its usefulness as a payment mechanism open opportunities for products and services for those who are connected to these markets and their dynamics.

Why is that happend? To answer this question, a sentence that the co – founder of Bitcoin Argentina, Rodolfo Andragnes. who made an analogy between Bitcoin and other currencies using the terms “Good money for bad money” during a MeetUp End of 2017. There He assured that people preferred to spend less value capital and save the wealth that had the best prospects for commercial growth in the future, comparing, for example, the fact that Venezuelan citizens spend Bolivar on daily purchases and in Save dollars.

The Bitcoin what we have now

Behind Hard fork from 2017 this led to the birth of Bitcoin Cash, Bitcoin implemented operational changes that to some extent solved the problems that existed on the network at the time. This also opened up space for implementing solutions such as Lightning network, This enables immediate payments at low cost through alternative channels.

From a functional point of view, however, beyond the updates and implementations for which Bitcoin, What has really changed over the years has been the perspective with which many users perceive the digital currency and see greater use as a store of value than as a means of purchasing products and / or services, based precisely on the idea of “Good money for bad money”.

So value of asset or means of payment?

With this in mind, the answer may be clearer Bitcoin Pizza Day. If someone wanted to buy a pizza today Bitcoin to commemorate this event I should consider at least some important considerations:

- Find a nearby pizzeria that supports Bitcoin as a payment method: This can be a major challenge in many countries. Statistics show that many traders originally accepted BTC They stopped doing so as this did not increase their sales margins / customer base.

- Make a transaction BTC for the equivalent value in fiat: The main setback is related to network congestion and commission margins. It is estimated that a user should pay a minimum of $ 6 commission for the process to be confirmed in the next 30 minutes.

If you plan to eat pizza for dinner and pay with BTC, place your order

– 1 hour in advance for $ 5 fees.

– 30 minutes in advance for ~ $ 6.You can also pay with any other coin and have the transaction confirmed in minutes or seconds for cents on the dollar. pic.twitter.com/3vvfSRe1Wn

– GUBAtron??? (@gubatron) May 22, 2020

Finally, it is only necessary to ensure that the volatility of the price of the digital currency does not cause mixed reactions to the purchase made. Since a very possible scenario is for the asset to add value in the coming weeks or months, you feel like you ended up paying too much for a pizza … something that still thinks of those who do take that into consideration Laszlo Hanyecz paid 10,000 BTC for two of them.

In a very personal capacity, this author would prefer to pay with and save any other currency BTC for the not too distant future.

Articles by Angel Di Matteo / DailyBitcoin

Collage picture of Pixabay

[ad_2]

Add Comment