[ad_1]

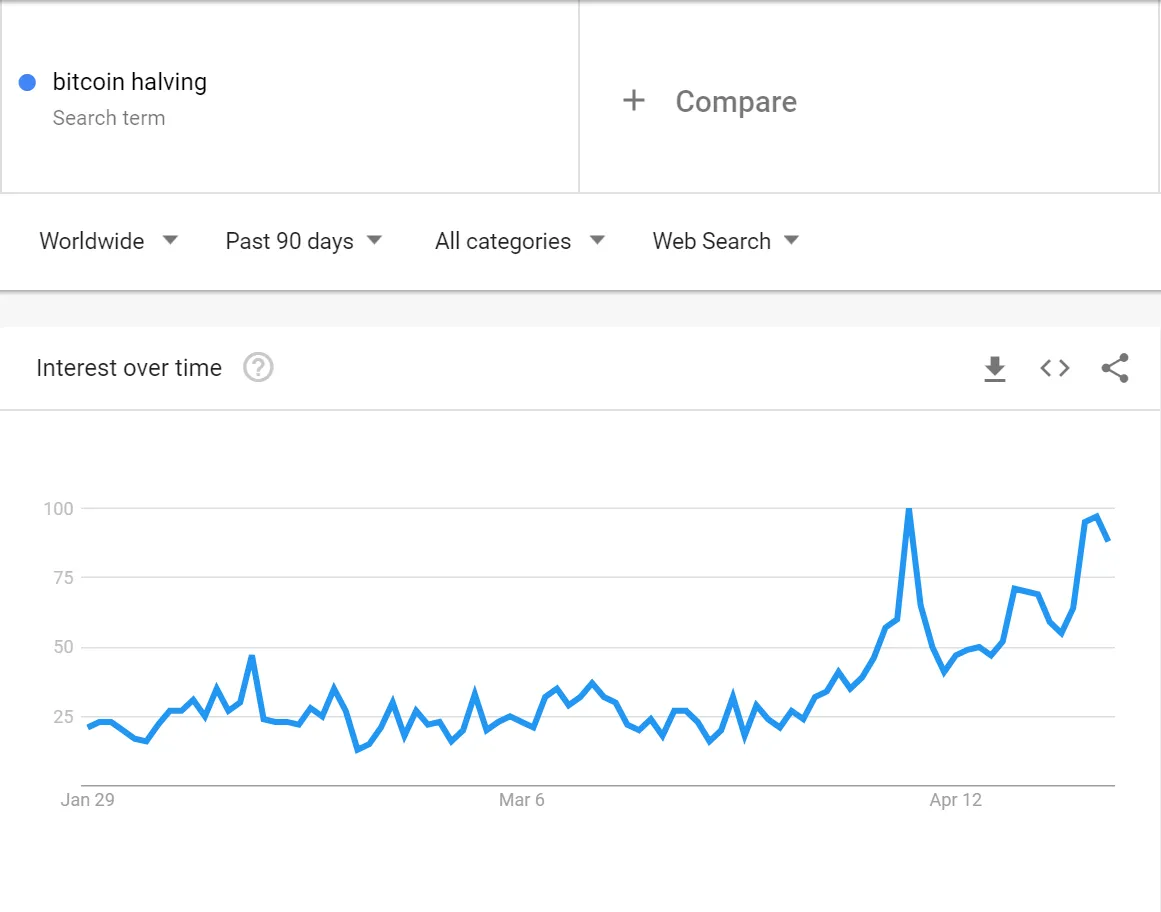

Over time, before the third halving of Bitcoin expires, interest in the search term “Bitcoin Halving” has never been greater. Google Trends shows that the number of searches for the term increased in April.

However, the data shows that Google’s interest in Bitcoin is nowhere near the level that has brought the price to its all-time high. This suggests that many of the investors who pushed prices below $ 20,000 at the end of 2017 are still not paying attention.

Google searches for “Bitcoin Halving” in the latest adjustments to the BTC offering

As BeInCrypto has repeatedly reported, the third halving of Bitcoin will take place next month. Binance estimates that the event will occur sometime on May 11th.

As can be seen in the picture above, interest in the shock of the wealth supply has gradually increased in recent months. The current values bring it closer to the highest search volume of all time that was observed a few weeks ago and are considerably higher than that observed in 2016, which halved.

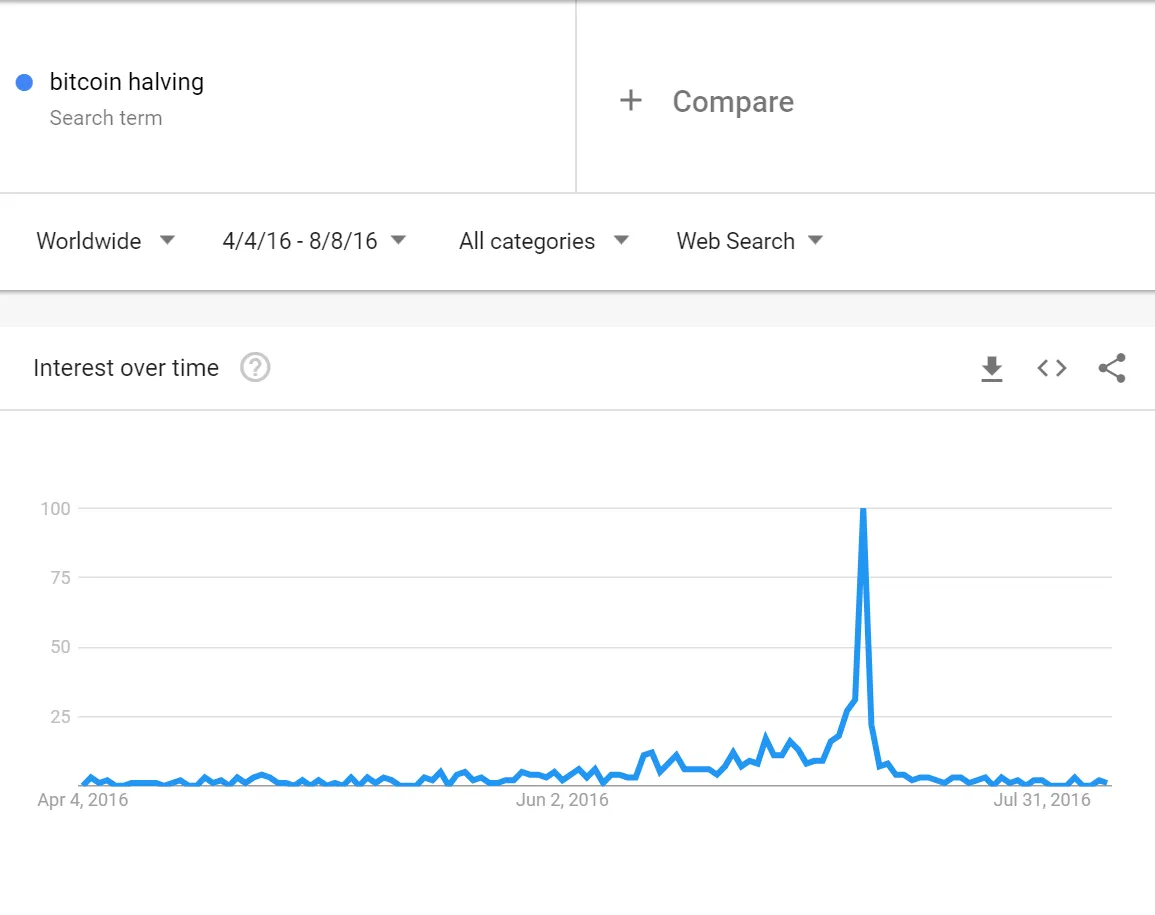

As the following data shows, interest in halving Bitcoin in 2016 has also gradually increased in recent months. After hitting all-time highs several times, there was a massive surge in Bitcoin searches themselves in the week of the event.

Since Google’s search for “Bitcoin Halving” already exceeded the 2016 peak several times this year, interest in a halving is significantly higher than in the last BTC issue in 2016. A similar peak would overshadow it 2020 highs, which already make the high of 2016 seem small.

The previous halving of Bitcoin preceded a one and a half year bull round that would push the price down to just under $ 20,000 in late December 2017. Since interest is already much higher this time, investors expect a similarly massive price movement. After halving, bring the price of BTC to a level that is currently unimaginable for many.

Google’s interest in “Bitcoin” shows that the masses are not yet interested

Despite the significantly growing interest in halving Bitcoin, Google searches for the term “Bitcoin” remain significantly below the previous all-time high. This suggests that the investors behind the 2017 purchase still don’t pay attention to Bitcoin in the previously known numbers.

However, interest in Bitcoin has increased since 2016. In addition to today’s much higher price, Google Trends shows that Bitcoin searches in the current week of 2016 only reached three percent of their all-time high. On the contrary, less than two weeks before the third halving, the number is 12% of the all-time high in December.

This appears to support a popular theory about the bitcoin industry. As BeInCrypto has previously reported, many analysts argue that a further rise won’t start until Bitcoin surpasses the all-time high of $ 20,000. Google data from 2013 (the previous all-time high) and 2017 show that parabolic price movements towards new highs are generating much broader interest in Bitcoin than the halving events themselves.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the Cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Read moreRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend to present sufficient information to make a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those listed in the content of this article.

[ad_2]

Add Comment