[ad_1]

An organization that provides a non-custody credit platform for Bitcoin

BUY NOW It has partnered with some of the biggest names in the blockchain industry to collect donations and develop a native decentralized financing solution (DeFi) for Bitcoin.

BUY NOW It has partnered with some of the biggest names in the blockchain industry to collect donations and develop a native decentralized financing solution (DeFi) for Bitcoin.

Atomic Loans raised $ 2.45 million in a launch round led by Initialized Capital. The financing round included a provider of blockchain solutions Ethereum

BUY NOW, ConsenSys and Morgan Creek Digital, the investment company for digital assets, among others.

BUY NOW, ConsenSys and Morgan Creek Digital, the investment company for digital assets, among others.

DeFi for Bitcoin

Atomic Loans is essentially a platform that enables a two-sided market for Bitcoin-based loans. Users can lock their BTC natively to an unguarded deposit in the Bitcoin chain and borrow stable coins like DAI or USDC. It works similarly to DeFi credit platforms based on Ethereum, but with Bitcoin.

The team of three founded the company a year ago when Ethereum-based DeFi started. When the team realized that Ethereum had the benefit of scripting languages and smart contracts, they wanted to bring something similar to Bitcoin, and this round of seeds is where it came from.

The announcement summarized the current situation with a snippet from Anthony Pompliano’s “Off the Chain” newsletter, which stated that Bitcoin was being tested as currency while the financial services infrastructure was not being tested locally. In contrast, Ethereum is not tested as a currency, but has a proven DeFi ecosystem.

Min Teo, partner of ConsenSys Labs, said that Bitcoin will be a key part of DeFi activities, adding:

The vision of creating a parallel financial system without permission and open to everyone goes beyond chains and communities …

Pompliano himself applauded the company and added:

Atomic Loans is building the decentralized financial infrastructure that Bitcoin is using as intended.

I am thrilled to be back @Atomic_Loans how they bring DeFi to Bitcoin.

Look at her! Tthttps: //t.co/qjGbNbG0j0

– Pomp ? (@APompliano) April 14, 2020

Today’s state of DeFi

The current state of the decentralized financial industry is heavily geared towards Ethereum, but a Bitcoin DeFi ecosystem would be more complementary than competitive.

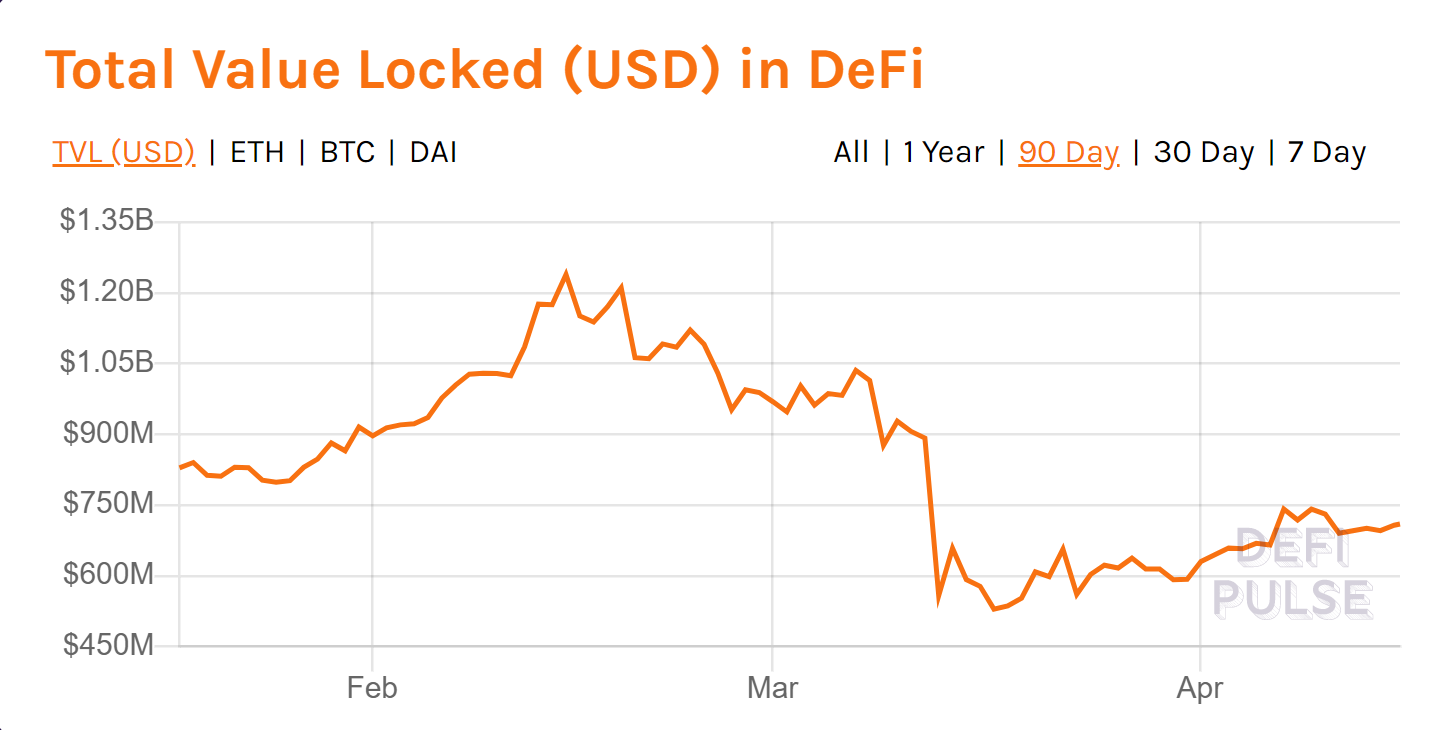

According to Defipluse.com, 2.7 million ethers are currently blocked in DeFi protocols as security for decentralized loans and credits. Based on the total blocked in USD, the value is USD 713 million.

The value of the dollar has fallen in parallel with the price of Ethereum, which fell off the digital cliff last month during the market crash caused by COVID-19. The record high for the DeFi dollar lock was $ 1.24 trillion in mid-February, a value that has increased 330% since the same period last year. However, since the peak, DeFi’s markets have shrunk 42 percent when the guarantee was settled.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the Cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Read moreRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend and do not intend to provide sufficient information for a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those contained in the content of this article.

[ad_2]

Add Comment