[ad_1]

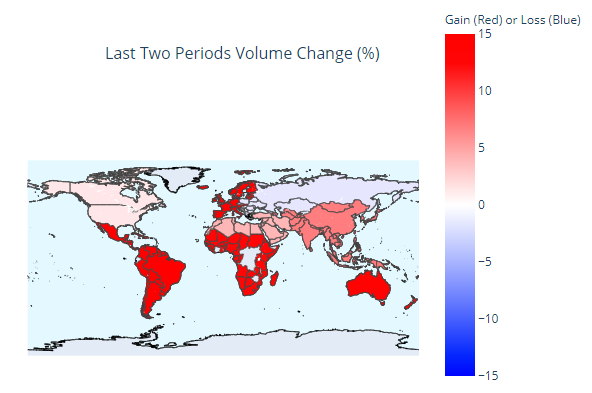

Latin America commands the train. Although it is a developing region, the enthusiasm for cryptocurrencies is undeniable. The region saw the highest growth in weekly trading in a 24% more bitcoins are exchanged on P2P platforms. Western Europe is in second place with 21%, followed by Australia with 14% and Sub-Saharan Africa with 13%

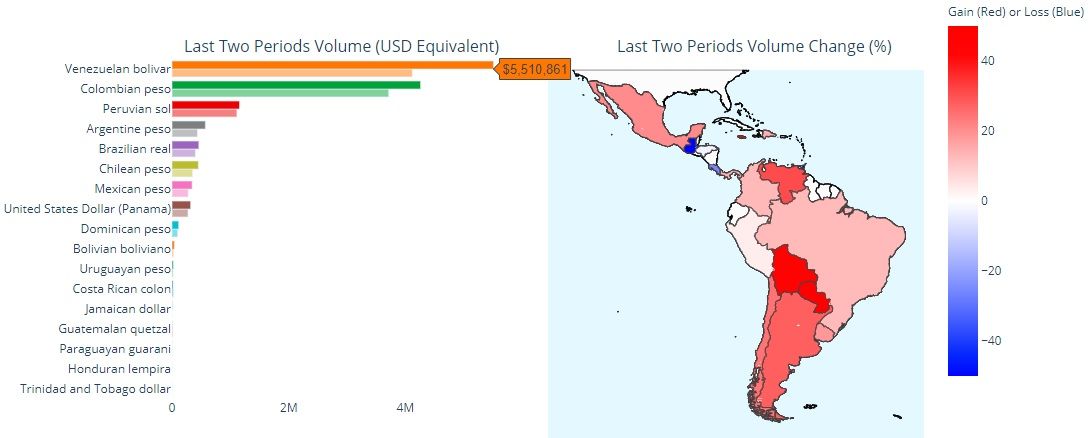

According to the metric website Useful Tulips, Latin America is the undisputed queen of Localbitcoins with one net $ 2.4 million increase to reach $ 13,283,977 last week.

Localbitcoins is the region’s most popular platform, and though it’s hard to believe, data report that Venezuela is the Latin country with the highest trade volume and growth between weeks. Despite being the worst economy in the region, more than $ 5.5 million has moved in the past week (more than 1 million compared to the previous week), followed by Colombia with $ 4.2 million, followed by Peru with $ 1.1 million.

However, when analyzing the combined data from Localbitcoins and Paxful (a popular platform among North American retailers), the picture changes a bit. Taking the Paxful trade into account, the North Americans exchanged $ 24.6 million net with an increase of nearly $ 400,000 Latin America ranks second with $ 13.4 million, but has the largest percentage increase per week.

Exchange platforms have their sights on Latin America

The dominance of Latin America in the P2P market has not gone unnoticed by providers of cryptocurrency exchange services. Paxful is taking various initiatives to position itself in the region and is trying to build on the success they have achieved in the north of the continent. Efforts have mainly focused on Colombia and building strategic alliances with various ATM service providers in the region.

For its part, HodlHodl has also tried to position itself as an alternative for Venezuelans who cannot comply with the strict KYC guidelines that Localbitcoins recently implemented. They also announced the addition of Petro as an exchange option, considering the fact that the government of that country is encouraging the use of this token.

Binance also recently announced the launch of support for Bolivar Fuerte – Venezuela’s official fiat currency – on its P2P trading platform to attract part of the audience that Localbitcoins has remained loyal to so far.

It seems that the prospects after halving could be positive, at least on P2P platforms.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis! Join the Cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Read moreRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information provided in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend and do not intend to provide sufficient information for a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those contained in the content of this article.

[ad_2]

Add Comment