[ad_1]

We have long heard the opinion of many people about Halving and its possible consequences for the valuation of Bitcoin. This time, however, we’ll focus on some expert opinions on what mining Bitcoin after halving could mean for miners.

First of all, it is most obvious that miners receive less reward for their efforts because the protocol halves the block’s reward. That said, mining Bitcoin may not be as lucrative if prices don’t change further or costs go down.

This reward is the number of cryptocurrency miners they receive when they successfully validate a new block. You do this by solving very complex math problems with your mining hardware.

Mining Bitcoin usually has high electricity costs, so in one way or another you need more benefits than spending to be profitable.

Background of the upcoming Bitcoin halving

When Bitcoin was launched in 2009, miners received 50 BTC per block. A total of 10,500,000 BTC was generated before the next halving in mid-November 2012. There the miners received 25 BTC for each block.

The next bitcoin halving took place on July 6, 2016, when 420,000 blocks were produced and miners started collecting 12.5 BTC for each new block. As you know, this is the current rate. The next halving halves this reward again, leaving the reward for each block at 6.25 BTC.

The last bitcoin halving is expected to take place in 2140, when 21 million bitcoin are mined. This is the planned ceiling. Once this happens, miners will no longer receive block rewards, but will retain the remaining source of income – the fees paid for the transactions they collect.

Mining bitcoin today: how is it done?

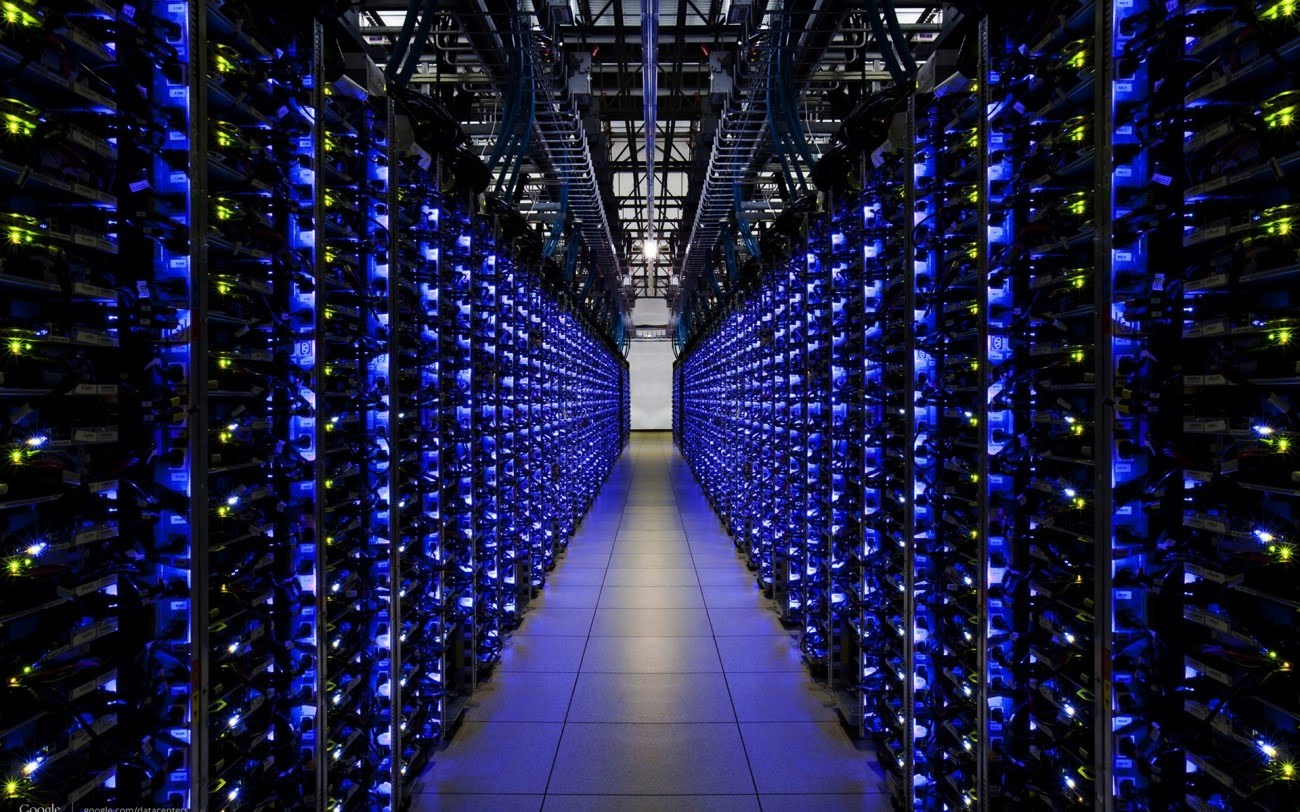

At this point, most of Bitcoin mining is done by giants like Bitmain, the renowned Chinese company.

Bitmain validates blocks with thousands of extremely powerful and energy-consuming machines. These machines are called Miners with integrated circuits.

They are much more efficient than the basic settings of the individual miners. As a result, mining Bitcoin in bulk is almost the only job for mining operations.

What is usually expected after a halving process is the rise in the price of Bitcoin, as has historically been the case. This is how many miners are stimulated by waiting for future benefits.

This won’t take long since the halving is expected to occur in May, but the reality is somewhat uncertain for miners.

It should also be noted how the dynamics of the bitcoin mining industry have changed since the last halving. There are currently more miners than in 2016.

In addition, bitcoin mining has left places like China and reached countries like Kazakhstan and Iran due to relatively low electricity costs.

What do the experts say about Bitcoin miners’ expectations after halving?

Ethan Vera, CFO of Luxor Technologies, recently gave his opinion on this in a CoinDesk podcast. It is worth noting that Luxor Technologies is one of the largest cryptocurrency mining groups in North America.

The fall of March 12 changed the landscape of many miners while waiting for the bitcoin halving to return. Many of them replied, but others could not continue because “the benefits were not,” Vera said. The consequence of this event was a significant decrease in the hashrate.

With that in mind, we can add the opinion of Delta Exchange CEO Pankaj Balani, who stated that the miners did not even expect these circumstances. Instead, they piled up Bitcoin and waited for its value to rise during the cut in half.

When this decline occurred, the prospects for miners changed a bit as they mix the natural consequences of halving their reward with a market crash. Without going into much depth, this meant a loss for many individual miners.

Vera also stressed, however, that miners who were able to overcome the crisis now have fewer competitors and are somewhat positive. In addition, given the recent gradual recovery in the price of bitcoin, many miners remain optimistic about the future after halving.

Miners mine when it benefits them

It’s important to talk about hashrate to understand the future of Bitcoin mining. Halving is expected to have a lower hashrate. Vera estimates that a drop of 30 hexahashrates will be generated in the short term, but she doesn’t think this is a real problem for Bitcoin.

Regarding the further effects, he estimated that the network will remain largely secure. In May 2019, just a year ago, the hexahash rate was 45, and network security was seriously questioned at that point. However, Bitcoin stayed for many months.

On the other hand, Vera realizes that something that could have more impact is: “Many miners are on the brink of financial incineration“” He points to the possible effects of the global economic downturn and the March 12th loss, situations that many miners may not be able to endure.

As a result, many will likely leave the Bitcoin community.

Additional considerations

To sum up Market factors determine who makes money and who doesn’t. There is no real way to fight it. The miners’ profits after halving depend on whether the market follows the historical trend or whether it varies with COVID-19 due to global developments.

That means miners are at risk of things not going as expected and losing their investment. For this reason, Vera assures that some tools are required to help miners reduce this risk.

“I hope that more funds are available for the hashrate and that miners take a more long-term approach, similar to other industries.”

Ethan Vera, Luxor Technologies.

Many experts talk about financing hashrates, others about cheaper and more efficient mining machines. It is also important to consider the number of machines that may be available on the market as a determining factor for the overall network hashrate.

Vera, however, ensures that Bitcoin miners need to focus on how to optimize the value of the hashrate produced. That means they have to answer the question “How can I get more value for the hashrate I generated?” Especially after halving Bitcoin.

Conclusion

The miners who remain in the market are unwilling to lose and maintain their confidence in historical price developments after an episode of Halving. Therefore, they remain very attentive to what is currently happening with the halving of Bitcoin cash.

However, we have to consider the reaction alternatives that miners can have if things don’t go as expected after halving. The Vera mentioned in the podcast are just a few of the possibilities.

Many factors can affect the increase or decrease in mining after halving, but we believe that one of the most important factors has to do with the development of more efficient machines.

[ad_2]

Add Comment