[ad_1]

In the face of a possible financial crisis, readers indicated that they would rather save Bitcoin or other cryptocurrencies compared to gold / traditional markets.

***.

Although the explanation of a pandemic and the growing number of coronavirus infections COVID-19 In a variety of countries, it is currently holding millions of people on their toes, economists and analysts from various markets are drawing attention to the economic consequences that will occur in the coming months and which are already being felt in the United States, local and international economies.

The difficult outlook has already alarmed many people familiar with stock markets and new technology who are looking for financial assets such as Bitcoin or gold to protect their capital from a possible economic recession in order not to be affected by a possible global recession .

Traditional markets and fall by COVID-19

One of the sectors most affected by the growing number of infections COVID-19 It was the traditional stock market, as the uncertainty and clear limitations in a pandemic scenario severely affect the operating capacity of the main companies to maintain their business and cause many investors to withdraw their capital for fear of a possible paralysis that would compromise your income.

This type of chain reaction led to significant declines in the main markets, with the oil company particularly affected. A barrel of oil is currently trading at around $ 22.6, which represents a price drop of more than 50% compared to the results in earlier this year.

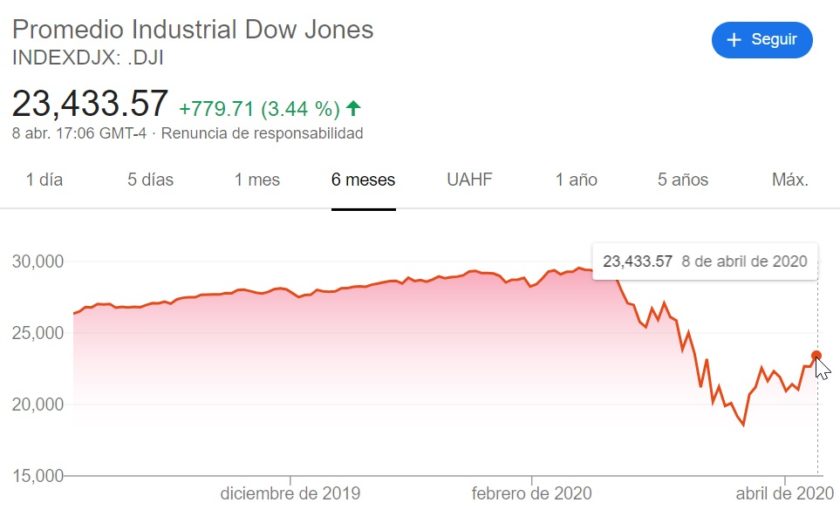

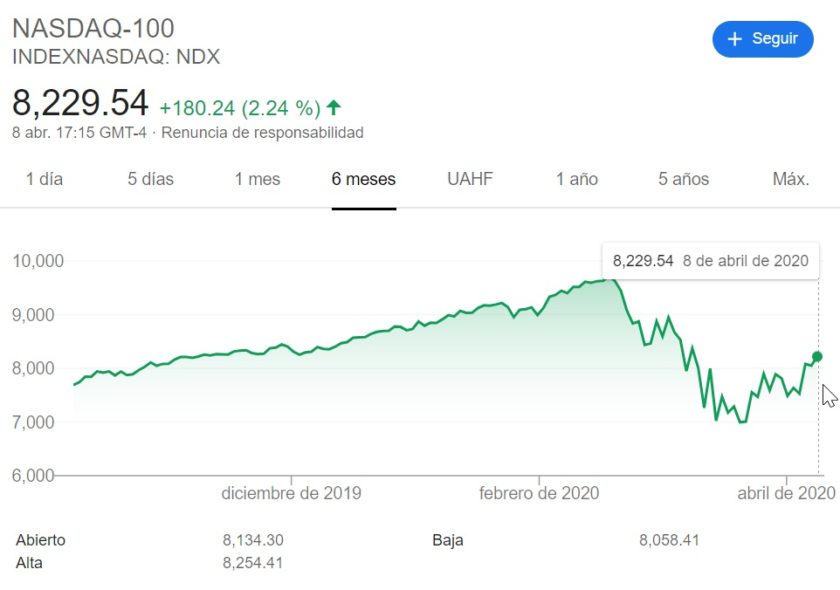

In terms of traditional markets, the industry indices are from Dow Jones y NASDAQ They have declined significantly since the end of February this year and reached their low point between March 19 and 20. These were the most critical moments for many of the traditional industries.

Although the situation has improved over the days, economists assure that it is still too early to establish a trend that points to a possible recovery, precisely because statesmen in the health sector assure that the world is still not the worst related scenario sees the spread of COVID-19. In this context, they point out that the number of cases could peak between late April and mid-May, indicating that Latin America and the African continent would see the worst face of the pandemic.

Rescue operations

To alleviate the impact of this situation on the decline in the market to some extent, most governments have implemented a number of contingency plans, focusing on securing citizens for the first time in quarantine regulations. On the other hand, they have also adopted other economic provisions to mitigate the impact of the market downturn on businesses and to some extent to ensure their sustainability given the difficulties in maintaining their normal business.

Based on the case of the US government, the Federal Reserve of the country (EDF) A significant rate cut, close to 0%, was decided in early March to mitigate the financial impact on the hardest hit companies.

In addition to the aforementioned measures, the currency company made a substantial contribution of approximately $ 168,000 million to support the local economy in these times of crisis. This corresponds to approximately $ 168,000 million. The agency then confirmed that it would print approximately $ 6 billion to support economic rescue initiatives for companies based in the country.

Gold rise

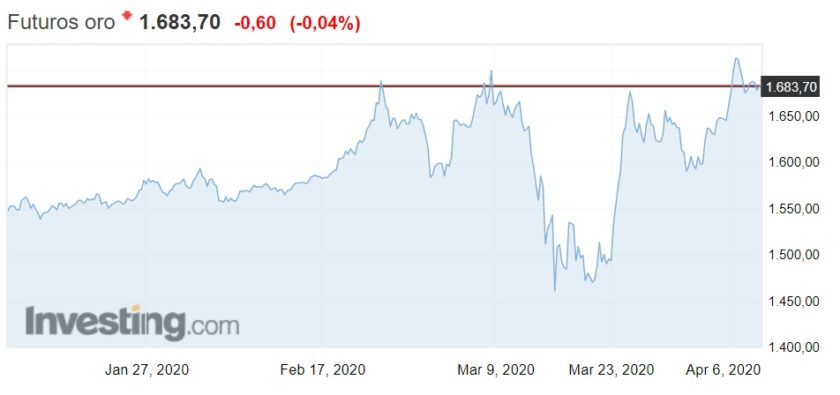

However, the most remarkable thing about this whole situation is that given the decline in local and international markets One of the best performances is that of gold. This metal, which economists consider to be the epitome of the value reserve, is currently at its highest level this year of uncertainty in other areas, despite the decline in mid-March, which shows great confidence among investors.

Impact on the crypto ecosystem

For its part, the cryptocurrency ecosystem was also significantly impacted by developments in the main markets, particularly the day between April 12th and 13th Bitcoin and some of the key altcoins saw significant declines in just one hour of trading.

Although the decline in key digital currency markets would be linked to current fears of case spreading COVID-19, Analysts point out that cryptocurrencies generally showed a very good trading streak with Bitcoin more than USD $ 10,300 per unit for that Halve which will take place on May 13th.

Although there was a significant price cut from Bitcoin and other digital currencies, economists, and cryptocurrency enthusiasts highlight the rapid recovery unlike other traditional markets, largely attributing this to its potential as an alternative technology that redefines the concept of money and to its face effects. for the future of the economy.

Poll: Readers Prefer Bitcoin and cryptocurrencies versus gold or stocks

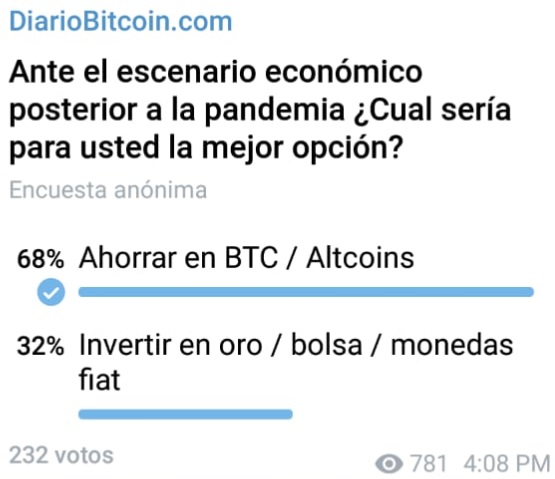

The team from DailyBitcoin opened a public consultation on their social networks to find out the opinion of readers who were asked what would be the best economic option given a post-pandemic economic scenario COVID-19.

In this regard, our group of Telegram, with a total of 232 voters, 68% of the participants said that they would rather save Bitcoin or another cryptocurrency, while the remaining 32% thought it would be more profitable to manage options related to gold or traditional markets.

The survey was carried out in turn Facebook showed results that tended mainly to invest in cryptocurrencies This would save 87% of the total of 283 participants Bitcoin or another digital currency, while the remaining 13% would seek refuge in historically more popular markets like gold.

Cryptocurrencies as an alternative to traditional markets

By reviewing some comments from readers who support investing in Bitcoin or other cryptocurrencies are mainly based on the fact that these assets function to some extent independent of traditional markets like gold and stocks. So a scenario of a possible recession would be very similar to that of 2008, an event that was highly motivated Measure the creation of the primary digital currency as a financial alternative that is specifically for people.

Another accusation that also gained strength among the voters was the fact that Bitcoin and the main cryptocurrencies are a guarantee of their value and offer their owners greater practicality in managing money. Contrary to what would happen to gold investors who could not simply exchange their money for the precious metal and use it even less directly to conduct trading transactions than if it were a fiat currency.

Renowned investors are in favor of it Bitcoin

Above all, the readers’ opinion also seems to match the comments of influential people in traditional markets who argue this Bitcoin It could become a very important financial asset for the future of the economy. One of them was Steve Wozniak, co-founder of Apple, the beginning of 2019 predicted that the cryptocurrency would become a world reserve currency for years to come.

Recently in the context of the current financial crisis due to the pandemic of COVID-19, the renowned investor and author of the book “Rich father, poor father”Robert Kiyosaki recommended his followers to invest in Bitcoin to protect his capital, as choosing the US dollar as a reserve currency is counterproductive amid the unprecedented impression of the US dollar Fed in March.

In the same order of ideas are the approaches of billionaire Tim Draper, who assumes that many people will invest in the digital currency when the upcoming financial crisis becomes more apparent and important changes in the economic models and capital markets from expected risk and business activities.

Finally, the announcement that caused the most sensation among readers had to do with what the former executive said Goldman Sachs, Raoul Pal, who said he invested in Bitcoin protect themselves from the possible financial crisis that will occur in the coming months. The investor supported its stocks by ensuring that the global economy is going through a complex scenario of difficulties that will affect new generations significantly and that stocks in the stock market will fall 20% in the short term before a recovery that could hopefully come. in about three or four months.

Related articles

The former CEO of Goldman Sachs invests in Bitcoin and warns that the worst bankruptcy scenario in history is approaching

Kiyosaki, author of “Rich Dad, Poor Dad”, recommended saving Bitcoin in the current financial recession scenario

Corona virus: its impact on the traditional and cryptocurrency markets

Corona virus: does this pandemic promote the adoption and use of cryptocurrencies as a form of payment?

Articles by Angel Di Matteo / DailyBitcoin

picture of

[ad_2]

Add Comment