[ad_1]

The demand for stable coins has reached a record level and has caused the world’s largest manufacturer to continue to mint them. rope

BUY NOW It has reached a record high in terms of market capitalization and has had bonuses traded on some exchanges.

BUY NOW It has reached a record high in terms of market capitalization and has had bonuses traded on some exchanges.

Skew’s cryptocurrency tracker has just reported that Tether’s market cap has reached $ 7 trillion.

USDT has just exceeded the $ 7 billion market cap and is consistently trading a premium over USD, suggesting continued demand pic.twitter.com/3JsHMD2kK2

– skew (@skewdotcom) April 18, 2020

Other analytical trackers such as Coinmarketcap.com are reporting a slightly lower value of around $ 6.4 trillion at the time of this writing.

Tether Coins record level

Since the beginning of the year, the USDT market capitalization has increased by a whopping 56%, putting it in the shade Bitcoin

BUY NOW, which only gained 2.3% in market capitalization in the same period.

BUY NOW, which only gained 2.3% in market capitalization in the same period.

As a percentage of the total cryptocurrency market, Tether now has 3%, which is more than Litecoin

BUY NOW y EOS

BUY NOW y EOS

BUY NOW combined. As reported by BeInCrypto, Tether raised another $ 120 million at the end of last week and has done so several times this month.

BUY NOW combined. As reported by BeInCrypto, Tether raised another $ 120 million at the end of last week and has done so several times this month.

Stable coin issuance rose to $ 8 trillion in the first quarter of this year, more than in 2019 combined. If USDT is traded with more than one dollar, it means a higher demand for the asset, which has been the case in the past few months.

What drives demand for USDT?

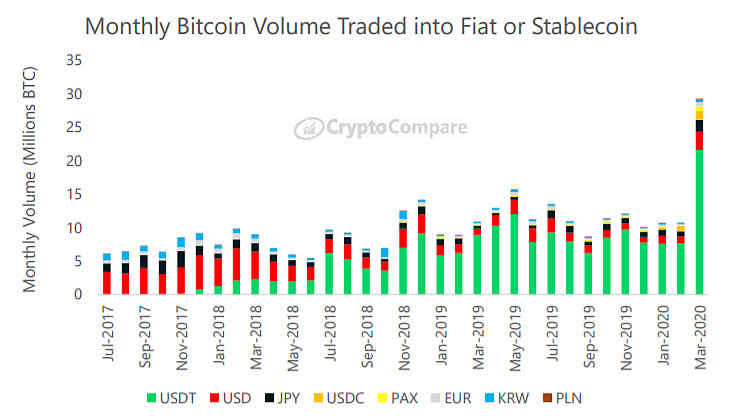

According to the monthly review of the CryptoCompare exchange, the volume of stablecoin increased in March. more than 21 million BTC, representing 73% of the total volume of BTC traded in Fiat or stablecoins.

Demand for other stable coins like USDC and PAX has also increased, but Tether is still the king of the crypto castle.

Analysts and traders in the cryptocurrency industry have largely viewed the increase in demand for stable coins as bullish, as this could indicate a willingness to buy cryptocurrencies at a time when the markets are bearish.

Another factor at stake could be that investors and traders are moving towards safer currencies because they fear their own devaluation. A stronger exposure to the dollar would be a good move in countries facing inflation problems due to economic pressures.

China is one of the countries where demand for tether has increased recently as traders look for liquidity and exposure to other digital assets through stablecoins. Fiat-to-crypto transactions are still banned in the People’s Republic, making Tether the preferred vehicle for entering digital assets.

Many exchanges like Binance also offer good interest rates for stablecoins that will not be available from any bank in the near future. This makes them more attractive than the “Fiat”; They maintain a “bond” that reduces the volatility and risk of more risky assets like BTC.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the Cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Read moreRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend and do not intend to provide sufficient information for a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those contained in the content of this article.

[ad_2]

Add Comment