[ad_1]

The Central Bank of Venezuela has filed a formal lawsuit against the Bank of England for possible misappropriation of funds to secure the release of nearly a billion dollars of Venezuelan gold in the vaults of Britain.

The money the government of Venezuela wants to get back corresponds to a deposit of around 31 tons of the precious metal that Venezuela has deposited with the British bank as part of the supply of its international reserves.

According to an email from the United Nations to the BBC news portal The Venezuelan government is ensuring that it desperately needs the means to receive medical care to fight the coronavirus epidemic. So much so that they asked for the release of the funds in exchange for the United Nations Development Program itself, which coordinates and manages all purchases of the requested inputs themselves.

However, this doesn’t seem to be enough for the Bank of England.

How did this confrontation between Britain and Venezuela start?

In recent years, especially during the management of Nicolás Maduro, Venezuela’s economy has been hit by a deadly cocktail of corruption, poor management and lack of growth. Add to that the unilateral economic sanctions imposed by the Donald Trump government with the express goal of accelerating the collapse of Venezuelans and forcing regime change, and it’s easy to see that the prospects don’t matter to people in Venezuela. Good.

Given the impossibility of having a “normal” business relationship with the rest of the world to buy basic living expenses for their people, Venezuela has decided to pay for gold to avoid the traditional banking system largely controlled by the North American jurisdiction.

However, after Venezuelan MP Juan Guaidó declared himself President of the Republic, there was a kind of international conflict over who is recognized as a legitimate president. [BBC] Of the 193 UN member states, almost 50 (including the United States and the United Kingdom) recognize Guaidó as president, and the rest have not supported its leadership for more than a year. [Diario las Americas]

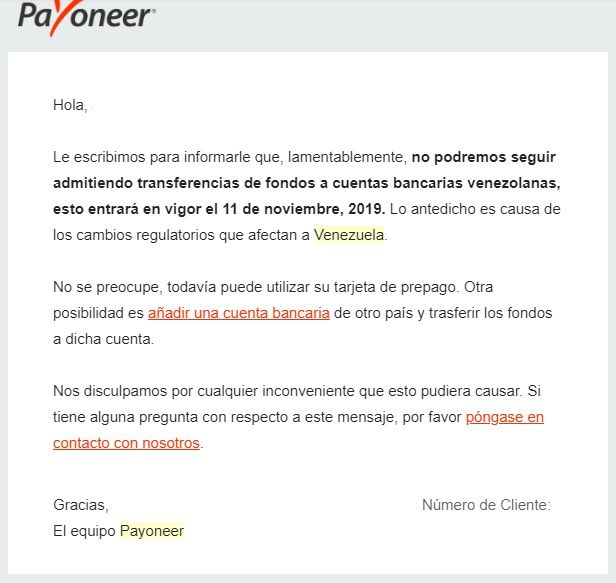

This step will allowed Guaidó to ask the Bank of England not to deliver the gold to Venezuela. [Russia Today] As part of his policy, Guaidó has the Sanctions tightened (which, for example, resulted in Transferwise, Payoneer, Adobe, Oracle and the provider of satellite television services DirecTV leaving) while at the same time taking control of PDVSA accounts and subsidiaries that Venezuela maintains abroad to avoid from Maduro regime to be treated.

The situation is worrying as Venezuela has been selling gold uncontrollably and has reduced its reserves to worrying lows. Many consider this to be funding illegal activities, while Chavismo supporters view this as a kind of necessary political survival measure.

Cryptocurrencies are breaking into modern geopolitics with CBDCs

The amoral character of Bitcoin

BUY NOW It has enabled him to participate in the global geopolitical game, with several countries trying to use this technology so as not to be dependent on third party control. From countries like France, China, and the Marshall Islands, which are concerned with creating their own cryptocurrencies, to Venezuela, Switzerland, and North Korea, which make money with Bitcoin, cryptocurrencies are here to stay.

BUY NOW It has enabled him to participate in the global geopolitical game, with several countries trying to use this technology so as not to be dependent on third party control. From countries like France, China, and the Marshall Islands, which are concerned with creating their own cryptocurrencies, to Venezuela, Switzerland, and North Korea, which make money with Bitcoin, cryptocurrencies are here to stay.

Venezuela understood this situation quickly and perhaps sooner than later had to admit that he owned Bitcoin as part of his international reserves. And although anti-American regimes are currently watching the world of cryptocurrencies with interest (more out of necessity than anything else), it is worth asking how much time is left for other countries to demand a little more independence.

The United States knows that and it is already getting down to business. The Postdoctoral Research Fellowship Program of the Office of the Director of the United States National Intelligence is already funding research studies that make this possible Solutions to keep the US dollar as the world’s reserve currency given the risk that the world will accept cryptocurrencies.

And while many enthusiasts still think in terms of fiat when evaluating the benefits of Bitcoin, The truth is that it seems that every day the countries of the world have more reasons to consider cryptocurrencies as a very interesting commodity.

Do you use telegram? Join the Telegram trading community to get exclusive buy and sell signals for cryptocurrencies, educational content, discussions and project analysis!

Join the cryptocurrency group on Facebook to comment on the latest news, share the best blockchain projects and trading signals, and win the market

Disclaimer of liability. Continue readingRead less

As a leading blockchain and fintech news company, BeInCrypto always strives to comply with strict editorial guidelines and the highest journalistic standards. With this in mind, we always encourage and encourage readers to do their own research into the information contained in this article. This article is intended as news and is for informational purposes only. The topic of the article and the information provided may have an impact on the value of a digital or cryptocurrency asset, but is never intended. Likewise, the content of the article and the information contained therein do not intend and do not intend to provide sufficient information for a financial or investment decision. This article is not expressly intended as financial advice, it is not financial advice and should not be construed as financial advice. The content and information in this article have not been prepared by a certified financial professional. All readers should always conduct their own due diligence with a certified financial professional before making an investment decision. The author of this article may have any amount of Bitcoin, cryptocurrencies, other digital currencies, or financial instruments at the time of writing, including but not limited to those contained in the content of this article.

[ad_2]

Add Comment