[ad_1]

All users of the crypto world have turned their attention to one event: Halving the Bitcoin blockchain. And it is the case that for many analysts, traders and cryptocurrency holders, this will be the crucial moment in BTC’s life when the price will rise just like 2017. However, what would happen if the price of Bitcoin did not rise after halving? Today we are trying to answer this question.

What is bitcoin?

Far from what you might think, the answer to what Bitcoin is is not easy at all. And it is the case that there is a strong split within the crypto community about the type of cryptocurrency. And where it should steer its development from now on.

A group that includes crypto influencers such as Anthony Pompliano And mining companies around the world see Bitcoin as a store of value. In other words, a financial asset that, like gold, is not directly related to the global financial market. So if it breaks down in the middle of a crisis, the port of value of the assets is preserved or even increases in price.

This view of Bitcoin has important ramifications for the development of Cryptoactive. If BTC’s goal is to be the “digital gold” of the future, it is important not to improve performance as a virtual currency. On the contrary, to maintain mechanisms that ensure the scarcity and desirability of investors and the constant rise in prices.

On the other hand, another sector of the crypto world believes that Bitcoin should stick to Satoshi Nakamoto’s original plan. In other words, to become a viable alternative to traditional fiat money. Therefore, it serves as a medium for the exchange of goods and services.

That would be the thinking of important personalities of the crypto world like Vitalik Buterin. And, unlike the first sector, it would push to improve the properties of the cryptocurrency such as scalability. What would improve its performance as a currency and therefore lead to mass use in trade?

What does that have to do with halving?

After explaining the basic situation in the crypto world, our readers will probably wonder what that has to do with Bitcoin’s Halving. And the truth is that it has everything to do. Well, the attitudes of each of these groups to this event vary depending on their position in relation to the type of Bitcoin.

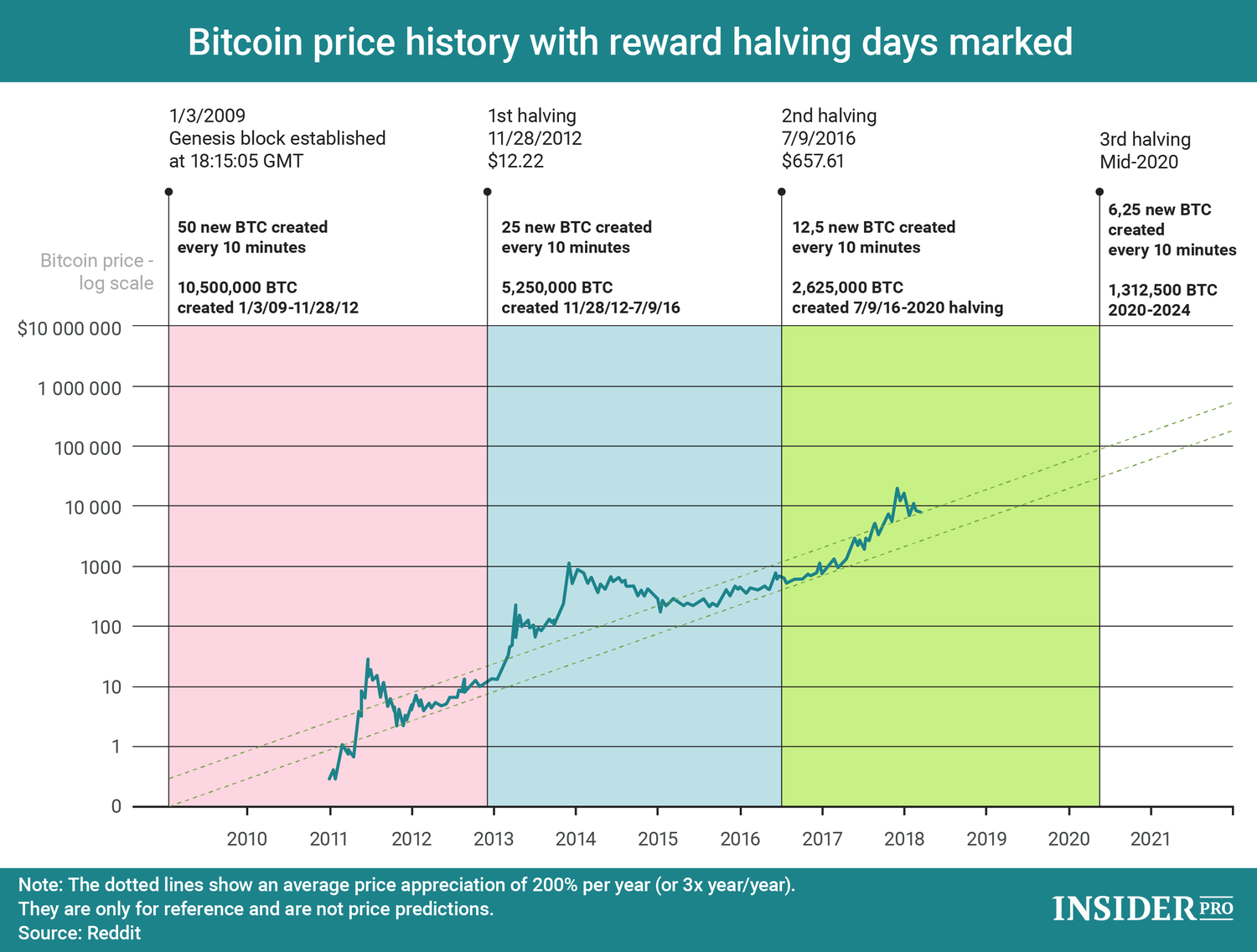

And the very first group that relies on the value of Bitcoin as an asset reserve has enormous expectations of Halving. Hoping the story will repeat itself, and just like the previous halving, the price of Bitcoin will skyrocket. Confirmation of its value as a port of value.

While for the second group, which primarily views BTC as a virtual currency, the rise in Bitcoin price is not that important due to the halving. Well, in contrast to the first group, for which this event is practically an all-or-nothing bet. For those defending bitcoin as an alternative to fiat money, it isn’t a disaster if the price of the cryptocurrency doesn’t skyrocket.

What if the price doesn’t go up?

So we come to the central question of our article: What if the price of Bitcoin doesn’t rise after halving? And the answer to this question depends on who you ask. If you speak to a member of the group who sees BTC as a valuable asset, it’s likely that the price of Bitcoin will be a disaster for that person, jeopardizing the future of the cryptocurrency.

While for those defending Bitcoin as a virtual currency, halving doesn’t have the effect expected by maximalists, this is a real possibility. However, this does not have to prevent BTC from fulfilling its function as an alternative to Fiat funds.

If the price of Bitcoin does not skyrocket after halving, the influence of the second group on the first is likely to increase. And therefore a shift in the development of Bitcoin towards the establishment of the necessary infrastructure to ensure its scalability and thus its worldwide use as money.

[ad_2]

Add Comment